Last week, a bunch of publicly traded DTC brands released their 2024 annual reports.

I love digging into these, because:

- They offer great data on the market as a whole

- You get to see how 10-figure brands operate

- You realize sometimes they’re no different than you, and that insight can help you make decisions about your own company

I realize not everyone is used to pulling these regularly, so here’s a quick CFO’s guide on how to get the most from them (along with some insights from my review of YETI’s in particular).

1. First, look at the basics…

Scan the P&L and related notes for a high-level review of how things are trending, and what it could mean for the broader consumer market.

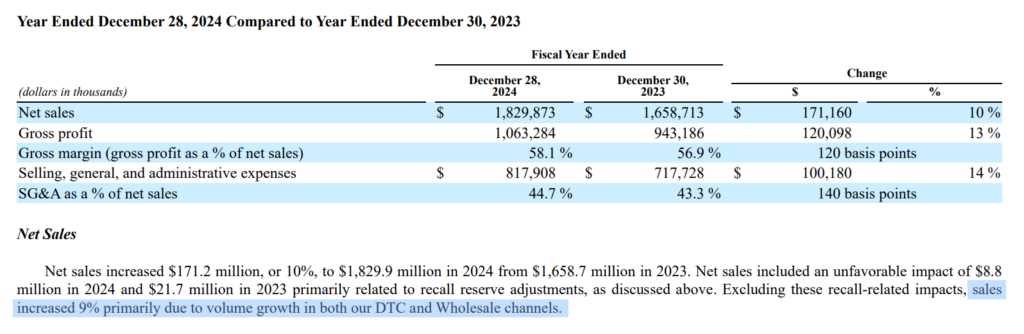

For example, with YETI, we quickly see that…

- Net sales were up 10%

- Gross profit was up 120 basis points (1.2%)

- Both DTC and wholesale revenue grew substantially (9-12%)

All of these are in line with findings from our annual benchmark report including public and private companies. So even though they’re doing much more revenue, the trends are surprisingly similar and relevant to us.

2. Pay close attention to the notes…

One big benefit of these reports is that you get an inside look at how billion-dollar brands think about things like recognizing revenue, managing inventory, keeping cash on hand, etc.

Even if you never want to go public, these insights can help you level up.

Sometimes, they’re obvious. For example, here we see YETI actually reduced inventory

That’s interesting, given all the talk of tariffs these days. Perhaps a signal to smaller brands to consider the safety of cash on hand, rather than stocking up on un-tariffed inventory that might not sell.

Other times, you have to read a little more closely.

For example, the words, “marketing expenses” are doing some heavy lifting here. They’re mostly talking about ad spend.

By reading the notes elsewhere, we learn two additional things:

- Ad spend went up by $14.6M for the year

- DTC revenue went up by $89.9M

So for every additional dollar of ad spend last year, YETI saw approximately six dollars in increased DTC revenue.

That’s not a perfect look at ROAS – it’s possible their ads got more efficient too (we saw ROAS lift as high as 4% in our benchmark report).

But it gives you a useful yard stick by which to analyze your own brand’s performance, which brings me to my final point.

3. Think about how these numbers apply to your brand…

Often, when it comes to budgeting, clients are just looking for a good benchmark or rule of thumb they can use to set goals.

These reports are great for that.

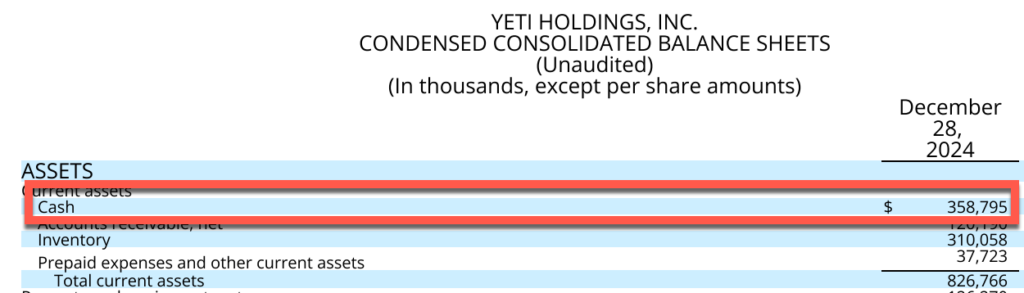

Take cash on hand, for example. A good rule of thumb is to keep enough to cover three months’ operating expenses (the expenses you would still owe if revenue goes to zero)

But is that really what other brands do?

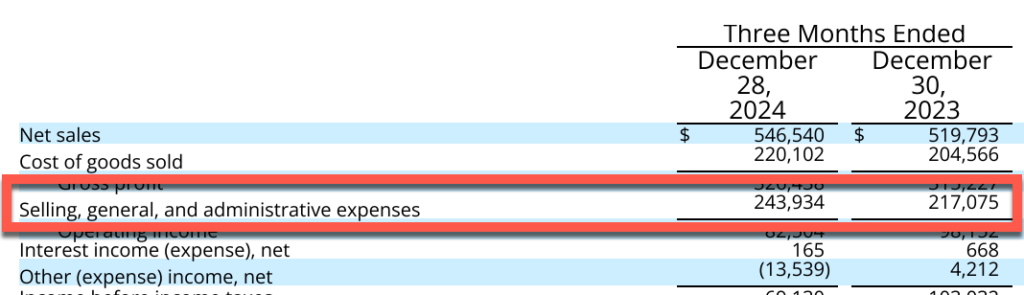

Well, if we look at YETI’s books, we see their overall SG&A spend in Q4 ranged $217M-$244M over the last two years. So we would expect to see at least that much cash on hand if our rule holds up.

Sure enough, a look at the balance sheet shows $359M cash on hand at the end of the year (enough to cover about 4.5 months) – another useful yard stick as you think through the year ahead.

In every decision, there is both art, and science…

What you choose for your brand always comes down to some combination of:

- Best practices (e.g., data you get from reports like these – this is the “science”)

- Your personal risk tolerance and vision for the kind of company you want to build (this is the art).

Public filings are a huge asset, when you know how to use them right.

Two final notes…

First, pay attention to what’s not mentioned in these reports too. For example, the word “tariff” doesn’t appear a single time in the press release YETI published, summarizing their 10K and 2025 outlook.

And second, take what is there with a grain of salt. Remember, companies are conveying this info because they are compelled by law and to attract (or at least maintain) investment. Their incentive is to be as optimistic as possible.

Example: YETI CEO, Matt Reintes, referred to last year as, “a market colored by a dynamic macro and competitive environment.”

Translation?

“Shit’s hard out there.” Don’t feel bad if you’re struggling. Everyone is.

Grab time on my calendar if you want to talk about it.