Customer Lifetime Value (CLTV or CLV), also referred to as Lifetime Value (LTV) is one of the most misunderstood metrics when measuring an ecommerce business’s performance.

In this article, we use CLTV, CLV, and LTV interchangeably, but they all mean the same.

CLTV in simple terms is the total profit that you generate from a customer over the life of that customer.

Simple enough definition – but can cause drastically different decision-making if interpreted incorrectly.

We classify LTV as one of the 5 most important metrics in ecommerce.

And this metric matters most in decision-making for customer acquisition and retention through marketing, customer experience, product improvement, upselling, and customer loyalty programs.

Owners grapple with defining their customer lifetime value (CLV) due to the limited information available on their e-commerce apps like Amazon and Shopify.

The Problem with Understanding and Calculating CLTV

From the definition of CLTV, it may seem the calculation is straightforward.

However, there are numerous pain points in determining CLTV:

- Definition |Owners fail to distinguish customer lifetime value from customer lifetime revenue – which is the gross amount a customer will spend over their entire relationship with your business.

Of the two, lifetime value is more useful in management decisions as it shows:- If your core unit economics are working

- A general budget for customer acquisition

- How fast you can afford to grow

- Amazon | Amazon is stingy with customer information – making the calculation of CLTV from the platform difficult or impossible

- Generic Apps | Owners who use generic Shopify apps to automatically calculate CLTV are misled and confused because the app doesn’t explain how the CLV is obtained

- Limited Access | Another challenge with these e-commerce tools – including Shopify – is that they don’t have access to complete data, particularly with costs, thereby creating inaccurate LTVs for decision-making. Shopify will mostly pull revenue numbers and some elementary cost data that you’ve inputted while omitting vital cost data necessary for calculating lifetime value.

- Constantly Changing | Many moving parts in determining the CLTV of a business as customer acquisition, products, and marketing strategies rapidly evolve

Defining Customer Lifetime Value (CLTV)

Above, we stated CLTV is basically lifetime profit. But more technically, CLTV is the lifetime contribution margin of a customer to your business.

If you’re confused about contribution margin, check out our article on contribution margin. Seriously, it’s important.

Again, customer lifetime value shouldn’t be confused with lifetime spend or customer lifetime revenue – the aggregate sales of a customer throughout your relationship.

Basic Single Customer CLV

Let’s start with calculating basic CLTV for a single customer.

Step 1. Calculate basic contribution margin

Contribution margin = Net sales minus variable costs.

Usually, we would include CAC in the calculation. But for now, exclude it.

To get the contribution margin, take the customer spend and deduct from it the variable costs:

Contribution margin = customer spend – variable costs (product costs, packing and shipping costs, assumption for returns)

Let’s look at a single customer who purchases the same type of product for a defined period. And let’s assume the defined period is 1 year.

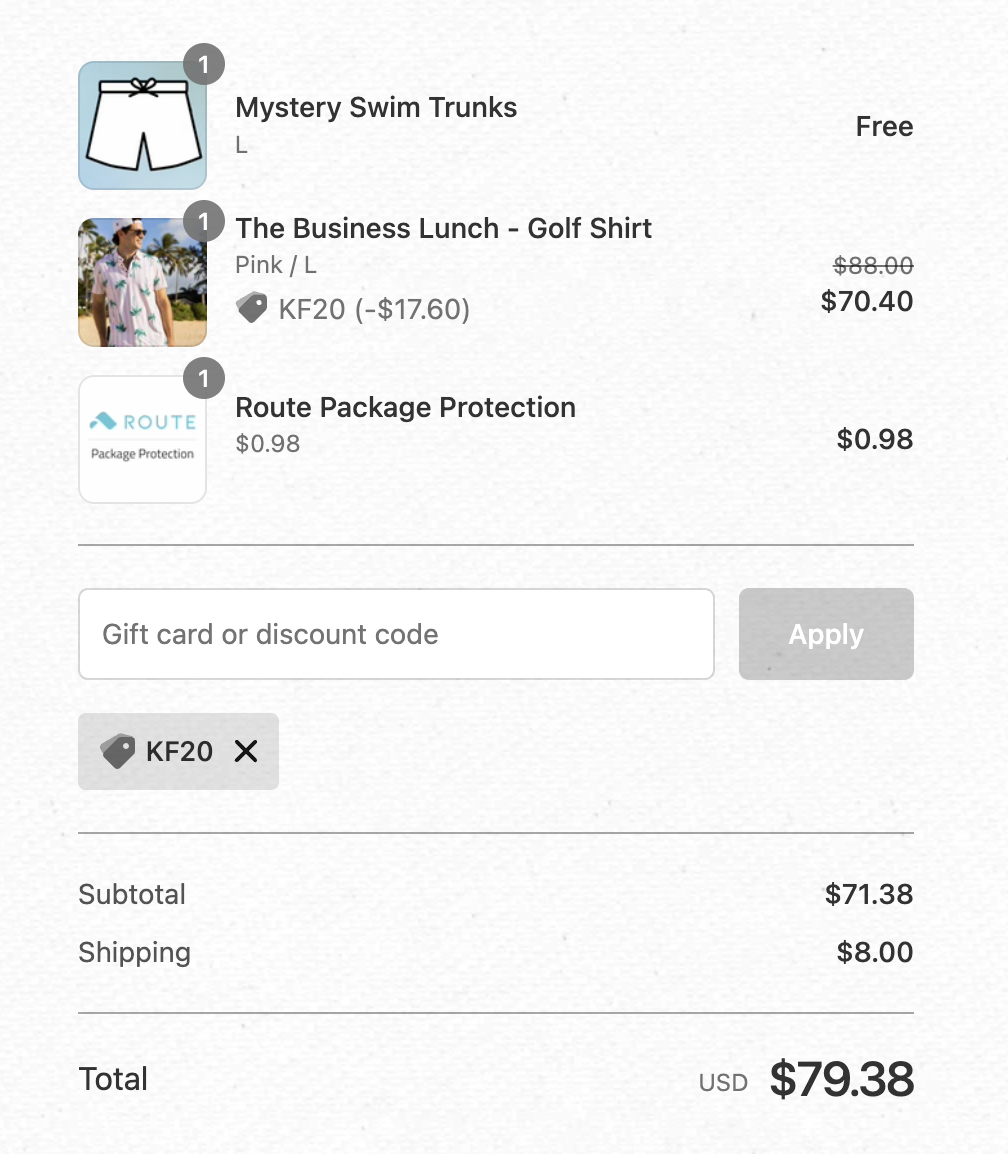

From the illustration, the customer pays $79.38 for the Business lunch-golf shirt. This amount is your net sales.

Next, add up the variable costs – the cost of the product, merchant fees, packing and shipping costs, etc. For this case, we’ll assume the total variable cost for each shirt is $40.38.

Contribution margin =Net sales [$79.38] – Variable costs [$40.38]

= $39.

Assuming the customer bought the same shirt three times over one year and variable costs remain the same, the contribution margin will be:

$39 x 3 = $117

Again [$117] represent the pre-CAC lifetime value for this customer.

Step 2. Subtract CAC from the contribution margin

Acquiring the $117 of value isn’t free, so we need to deduct the CAC to get the post CAC CLV

Let’s say, it costs you $29 (CAC) to acquire this customer.

We calculate the CLV by subtracting the CAC (only once) from the contribution margin that year. Although the customer bought the shirt 3 times over the year, we don’t subtract the CAC three times but only once.

Therefore:

CLV= Contribution margin [$117] – CAC [$29]

= $88

Fairly simple. Right?

Importantly, CAC is a one-time deduction! You may have additional marketing costs to the customer – retargeting, customer service, email marketing, etc – but these are not considered in the one-time CAC deduction.

CLV and cohorts

In the above example, for simplicity, we worked with a single customer who bought the same three items in one year – and then stopped purchasing from your store.

However, when calculating CLV in a real business scenario, you may need to work with clusters of customers to get data that is comprehensive and meaningful for decision-making. We call these cohorts.

A cohort is a distinctive feature that defines a group of customers – the month of first purchase, customers from a specific marketing campaign, customers who first purchased via Facebook, or an influencer, etc.

Measuring cohorts over time is critical. As you make new decisions, update ad campaigns, and launch new products, you want to track improvement or regression over time.

Note. When working with cohorts, you are generally working with AVERAGES AND DISTRIBUTIONS. Some customers within a cohort may purchase 10 times over 3 years, whereas many customers will only purchase once.

LTV to CAC Ratio

We often hear about LTV to CAC ratio and understanding the relationship between LTV and CAC is extremely important.

The steps are very similar to calculating LTV, except you’re dividing pre CAC LTV by CAC:

- Define a period – 6 months to 1 year

- Calculate the of a given cohort (excluding CAC)

- Calculate CAC for the cohort

- Divide the two

To interpret this, you would say “for every [$CAC] I invest, I receive [LTV to CAC Ratio] over [defined period].

For example, “for every $1 I invest, I receive $2.5 over 1 year”

Note | If the ratio is less than one, your business likely has a serious problem – the cost of acquiring customers outstrips the value you are getting from them.

Common Questions about CLTV

What’s a good CLV to CAC ratio?

This varies widely depending on the period. But generally within a year, anything less than 2 is poor.

Between 2-3 is considered “good”. And 3+ is above average.

Note that an extremely high ratio may indicate an underinvestment in the business.

What if my CLV is less than one?

When CLV is less than one, consider pausing the bulk of your advertising, refining your customer acquisition strategies, and reassessing core unit economics. The exception may be if you’ve received a considerable investment and are keen on revenue growth over profitability.

CLV and Amazon

Because Amazon is stingy with data, determining the CLTV of Amazon customers is challenging. If you run a subscription-based business, we recommend using the Shopify cohort data and applying it to Amazon customers.

Can CLV values change over time?

Yes! CLV is dynamic and continues changing with customers’ spending behavior and your decisions as an owner..

Still not sure about CLTV?

Schedule a call with us today to learn why CLTV is important and how to calculate LTV in e-commerce.