You look at various metrics to measure your company’s success: ROAS, conversion rate, customer lifetime value, average order value – you name it.

However, one critical metric is often overlooked: contribution margin.

Contribution margin helps you track product profitability and can serve as the foundation for strategic business decisions.

Understanding how to find contribution margin requires a comprehensive view of your business’s net sales and variable costs.

As a business owner, you can look at contribution margin holistically and/or more granularly. Or through the lens of customers and orders.

Insights into each of these levels provide different insights but are equally important.

Defining Contribution Margin

Almost all e-commerce platforms define contribution margin inaccurately. For example, Shopify downright butchers the definition of contribution margin.

According to Shopify, contribution margin is “the money left over from sales after paying all variable expenses associated with producing a product.”

Shopify’s definition is blatantly incorrect for a few reasons. First, it states “sales” instead of “net sales.” You can overstate your contribution margin considerably if you don’t exclude discounts and returns from sales.

Secondly, Shopify says “all variable expenses associated with a product.” However, when you calculate contribution at the business, channel, and customer levels, you look at the cumulative variable costs – not the variable costs associated with one particular product.

Our definition of contribution margin is net sales minus variable costs.

Net sales is straightforward. Net sales equals gross sales less discounts and returns.

Variable costs, on the other hand, are costs that fluctuate based on sales volume.

Variable cost example: Imagine you sell a backpack on Amazon for $80. Amazon charges a 15% referral fee for products in the backpacks, handbags, and luggage categories. Therefore, for every unit you sell, you must pay a $12 fee. The total referral fees you pay vary considerably depending on your sales volume. For example, if you sell 1,000 units monthly, you would owe $12,000 in fees. However, if you only sell 50 units, you would only owe Amazon $600.

Amazon referral fees are merely one example of variable costs that you likely incur. Other common variable costs include:

- Advertisement spending

- Customer support

- Merchant fees

- Commissions

- Shipping expenses

- 3PL costs (pick/pack/ship)

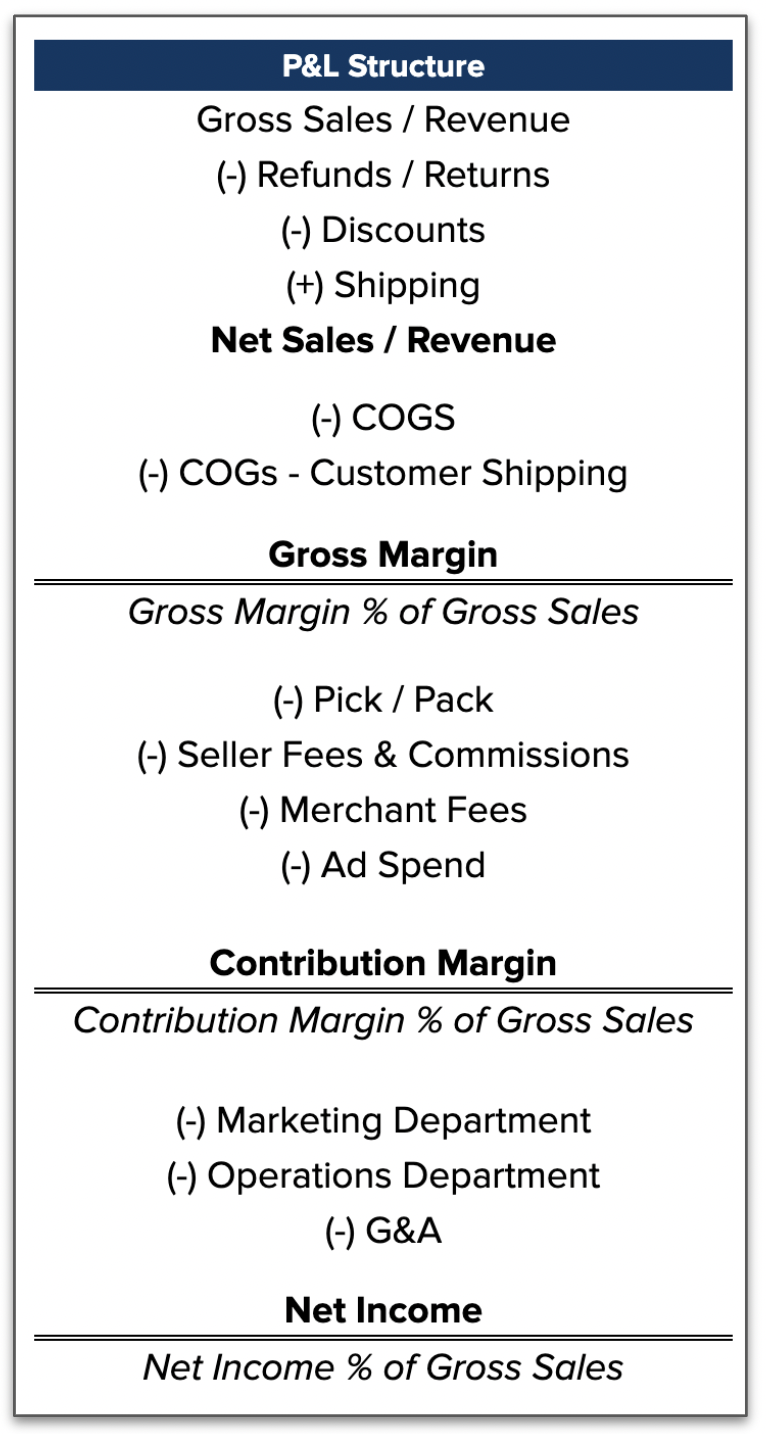

It’s important to note that contribution margin is not gross margin (net sales minus costs of goods sold). In a company’s P&L, the contribution margin generally comes below the gross margin (see the below example).

The Problem with Finding Contribution Margin

Based on its textbook definition, finding contribution margin seems relatively painless.

Unfortunately, that’s far from the truth. As the owner of an ecommerce company, regardless of your annual revenue, you will experience numerous pain points when calculating contribution margin:

- If you Google “contribution margin,” you will find that most explanations don’t apply to ecommerce business models.

- Contribution margin is multifaceted. There’s a difference between the unit, customer, channel, and business levels.

- The calculation is more complex if you have a subscription-based model.

- Attributing advertising dollars across multiple business lines and products is challenging, particularly if you run numerous marketing campaigns.

- After calculating contribution margin, you must compare it against a benchmark to make sense of it. However, how do you choose the right benchmark?

- Many contribution margin calculations are channel specific. That is, they’re specific to a particular platform – Amazon, Shopify, Wholesale, WooCommerce, etc.

Why Is Contribution Margin in Ecommerce So Important?

Contribution margin in ecommerce isn’t clear-cut.

A more traditional brick-n-mortar business has a much smaller list of variable costs that impact contribution margin.

Consider a landscaping business, for example. The variable costs for a landscaping business are labor, gas, and basic supplies, and that’s about it. These expenses don’t fluctuate much, which makes calculating contribution margin simple.

In ecommerce, many moving parts impact contribution margin, such as limited-time discounts, returns, and marketing campaigns. These variables also change drastically from month to month, creating even more complexity.

Despite contribution margin’s complexity in the ecommerce space, it’s the most valuable way to measure your profitability.

You can use contribution margin to make strategic decisions to increase profitability by reducing variable costs.

For instance, a low contribution margin could indicate that a particular product line isn’t profitable. By cutting that product line, you gain more resources to expand product lines bringing in more profit.

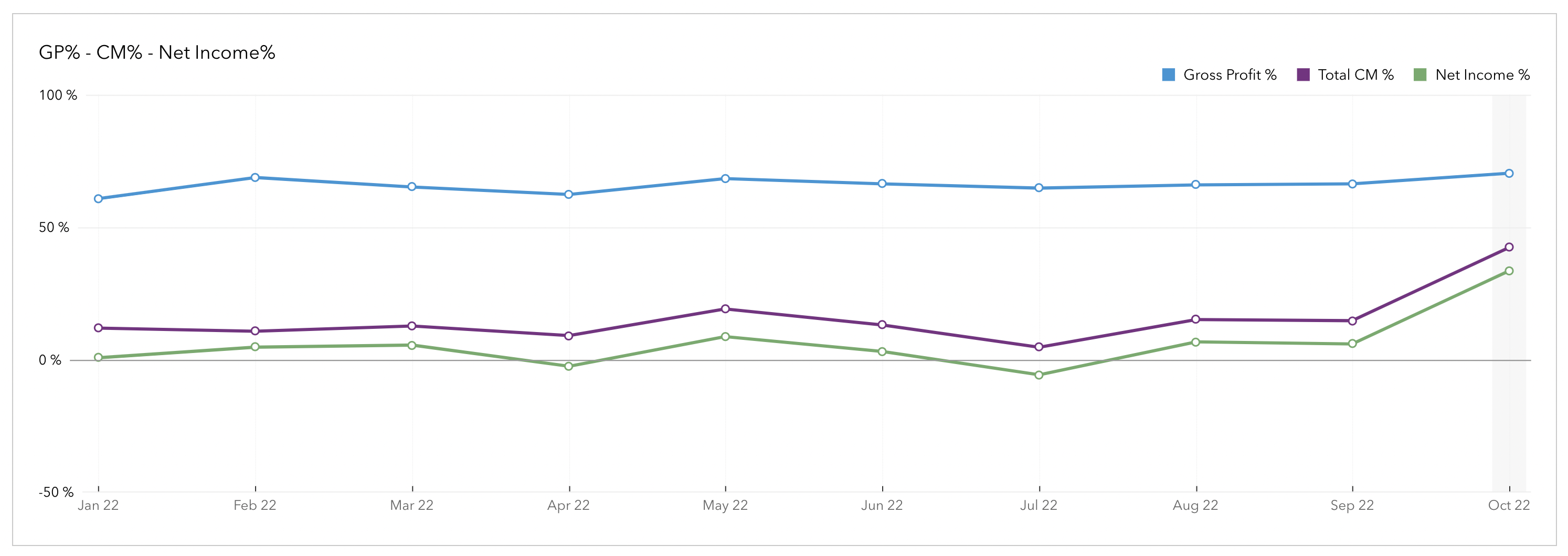

Contribution margin is often displayed alongside other metrics and compared monthly (see below). This graph allows us to see the relationship between gross profit, contribution margin, and operating income percentage across time.

The Basics of Contribution Margin at Each Level

Contribution margin allows business owners to make well-calculated decisions through four levels:

| Contribution Margin View | Description | Calculation Notes |

|---|---|---|

| Business | Aggregate view of the overall contribution margin of your business. |

|

| Unit/Order | Single unit or order |

|

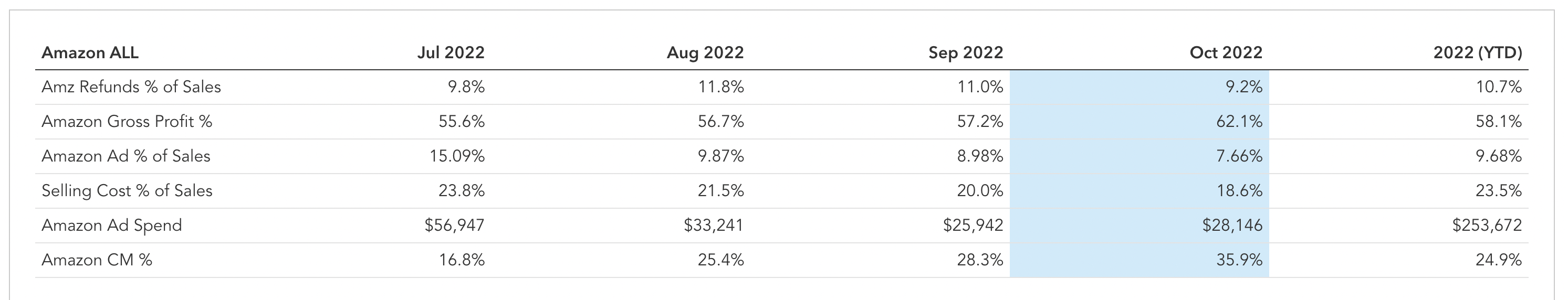

| Channel | This view of contribution margin considers a particular channel, such as Shopify, Wholesale or Amazon. |

|

| Customer | Similar to contribution margin at the unit/order level but extrapolates customer purchase behavior into the future. |

|

The below P&L shows an example of contribution margin for one sales channel (Amazon).

Common Mistakes with Contribution Margin

- Not paying close enough attention to it. Some businesses calculate contribution margin but don’t use it as a basis for management decisions.

- Believing that contribution margin is the same as gross margin. Gross margin only considers the cost of goods sold (COGS), which doesn’t constitute all variable costs.

- Assuming return on ad spend (ROAS) is more important than contribution margin. While return on ad spend is an important metric, it focuses on revenue, not overall profitability.

- Understanding the dollar impact of contribution margin versus the percentage calculated by taking net sales divided by variable costs.

Common Questions about Contribution Margin

- What is a good contribution margin ratio?The best businesses target an overall contribution margin of around 30%.

- What if my contribution margin is negative?A negative contribution margin means your variable costs exceed your net sales. If your contribution margin is negative, you may need to consider increasing your selling prices, reducing variable costs, and ending product lines that aren’t profitable.

- Can you increase contribution margin without cutting costs?Yes, you can increase contribution margin by increasing your prices, driving better ROAS, launching new products, new channels, etc. Consider using more resources to promote products with the highest unit/order level contribution margins.

- What happens if you don’t calculate contribution margin?Not calculating contribution margin makes it difficult to identify profitable product lines and optimal sales channels and gauge your business’s overall profitability.

Still Not Sure About Contribution Margin?

Schedule a call with us today to learn why contribution margin is so important.