I often get the question from new clients of “what does the team actually do” during the month. It’s not offensive. It’s a fair question.

It’s like me asking a developer what they do during the month.

I know they do coding stuff. And I can see the output. But I don’t have a computer science degree. I have no appreciation for the process and more technical aspects of their role that ultimately leads to the technology actually working.

But, it’s important for ecommerce owners to understand the principles and processes underlying their books.

So, here’s my explanation of what we do to create acquisition and investor grade financials in a month – hopefully explained in a less technical way.

1. PREPARING Your Acquisition Grade Financials

Below is an overview of key accounts and actions in preparing across the key components of your business.

Bank Accounts and Credit Cards

This is accounting 101. For every bank account and credit card attached to the business, we must reconcile the statement to the financials.

Most owners are generally familiar with how this works, but there are two basic objectives:

- Completeness – every transaction on the statement is accounted for in the financials (quickbooks)

- Categorization – every transaction on the statement is accounted for in the appropriate account

A2X

We use technology as much as possible to bring the most appropriate data and the most appropriate amount of data from your sales channels into Quickbooks.

And as your business and the environment evolves, we evolve with it: Amazon updates, new SKUs, cost updates, cart updates, Shopify configuration, merchant processors, new sales channels, etc.

Throughout the month and our relationship, we constantly update our technology configuration to match yours.

Examples:

- Adding a merchant processor

- Adding new SKUS and COGS

- Configuring a new ERP system

- Processing returns back into inventory

- Handling promotional products to influencers through Shopify

- Configuring Route and insurance providers

- Advising how sales tax flows through Shopify

- Faire and other wholesale platform integrations

Merchant Processors

You want to increase conversions and allow customers to pay however they choose. So, for every payment gateway, we make sure you are receiving every dollar by reconciling these statements each month.

We also make sure to represent any dollars you are owed from each payment gateway on the balance sheet (via clearings accounts) at the end of the month so you have a complete picture of your cash position and receivables.

Examples: Stripe, Shop Pay, Paypal, Amazon Pay, Braintree, Klarna, QuadPay

Amazon

If you’re selling any volume on Amazon, most of the work we do involves A2X. And the larger the percentage Amazon is for your business, the more attention it needs from us.

If you are selling in multiple countries or regions, we separate the sales, COGS, and fees in the most meaningful way for your business.

If you are selling via multiple methods – FBA / FBM – we separate this too.

On the balance sheet, we also reconcile how much Amazon owes you as of the end of the month – including the carried and reserve balances.

We will have discussed the initial setup during onboarding, but we continue to evolve with your business.

COGS / Inventory

Treatment of COGS generally depends on the complexity of your supply chain, impact of shipping costs, and your internal team’s capabilities

During onboarding, we will have discussed how we’re managing COGS for your business. We typically apply 1 of the 2 following methods.

Hybrid (most common)

In most cases, we’re maintaining a monthly master COGS file with your input.

We upload that file to A2X to systematically track COGS.

The complexity is what the master COGS file actually represents. In its simplest form, these amounts are pulled directly from the supplier purchase orders or invoices.

Then, we book all other COGS in the month the expense was paid.

Examples: Freight, Tariffs, Custom & Duties, Packaging, Tooling, etc

Full Accrual

In some cases, the COGS values you provide include not just the list price but also all of the additional components – freight, tariffs, etc.

We still maintain a master COGS file and use those values to upload to A2X.

Inventory

Depending on the method above, we maintain the inventory account as close to reality as possible.

We book invoices received and/or payments made to suppliers on the balance sheet in the inventory account – to be relieved by the COGS method above.

We also sanity check the inventory account against 3PL and your warehouse reports. It’s never going to be exact for reasons longer than you care about, but our number satisfies investors and banks.

As with the other parts of your business, how we manage inventory evolves. For example, if you change your returns policy or decide to write-off old inventory, we ensure those actions are accurately reflected on the financials.

Categorization of Expenses

I think the categorization of expenses is a key part of our not-so-secret sauce. We’ve developed a best practice chart of accounts refined over dozens of brands and hundreds of millions in revenue.

We separate variable costs and fixed costs, and then we separate those into various departments.

It’s especially important to categorize the variable costs so we can more easily and accurately calculate contribution margin and other key metrics in step 3.

With fixed expenses, we typically separate these into 3 main buckets: marketing, operations, and general & administrative.

Similar to the sections above, it’s important we continue to evolve with your business – changing, adding, and removing categorizations as your business changes.

2. REVIEWING Your Acquisition Grade Financials

For all the work we put into preparation, our team puts your financials through a comprehensive quality control checklist.

And not just a generic checklist. A checklist we customize for you.

We’re checking and double checking for any duplicate entries, configuration issues, accruals, and a long list of other stuff.

And, you guessed it, we’re constantly updating the checklist after each month to make sure we keep up.

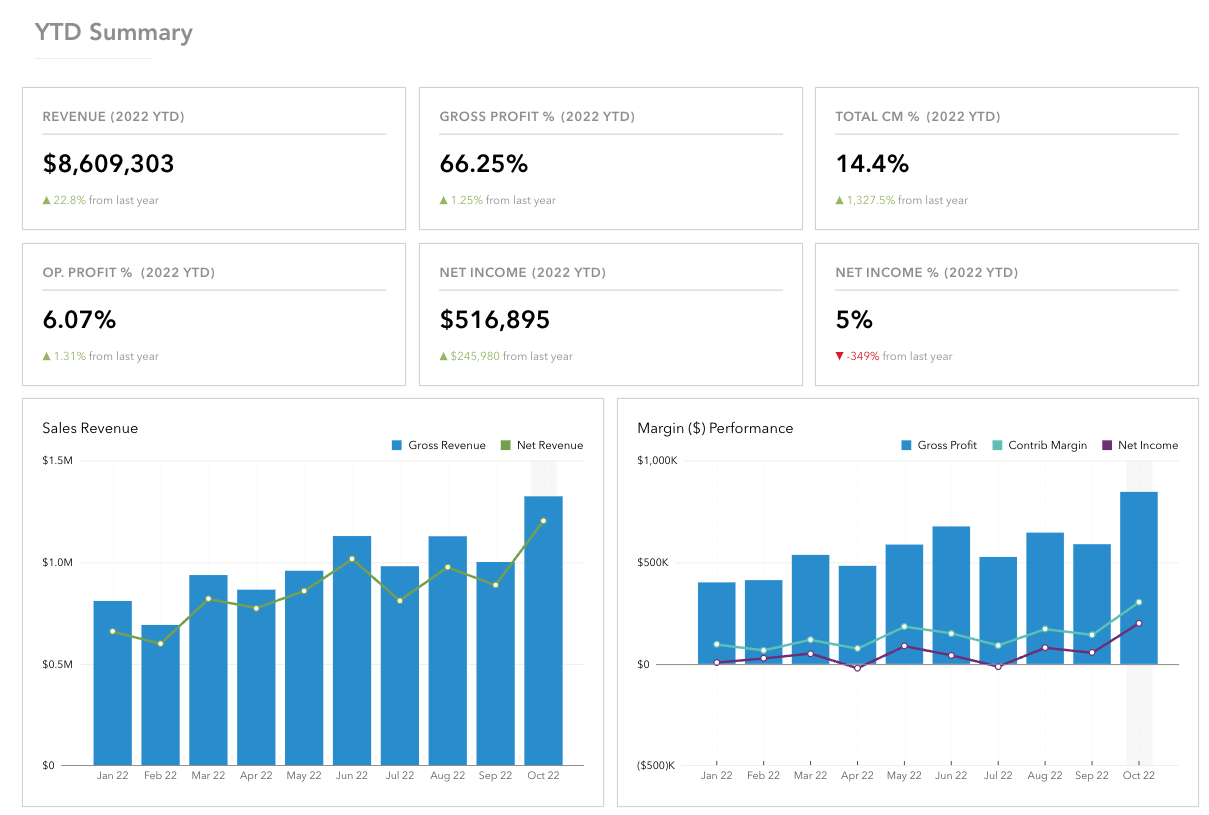

3. INTERPRETING Your Acquisition Grade Financials

Our monthly process culminates with translating and summarizing the accounting data into meaningful, actionable reporting via Fathom.

Because we’re so meticulous with the bookkeeping and accounting above, this becomes the fun part.

From our experience working with $150M of ecommerce annual sales, we’ve learned a few things about what clients want to see, but also what they need to see.

This report is meant to cover the company, channel, geography, and sometimes product type levels. We don’t have all the answers. But we’re using this data as a general barometer and as a guide where to allocate resources in decision making.

In this article, I won’t get into the interpretation of the metrics, but I think you’ll see how valuable they are.

Profit and Loss KPIs

We setup an initial framework based on our experiences and then discuss and customize for your business

Example KPIs

- Refunds % of Sales

- Discounts % of Sales

- Gross Margin

- Selling Costs % of Sales

- Contribution Margin

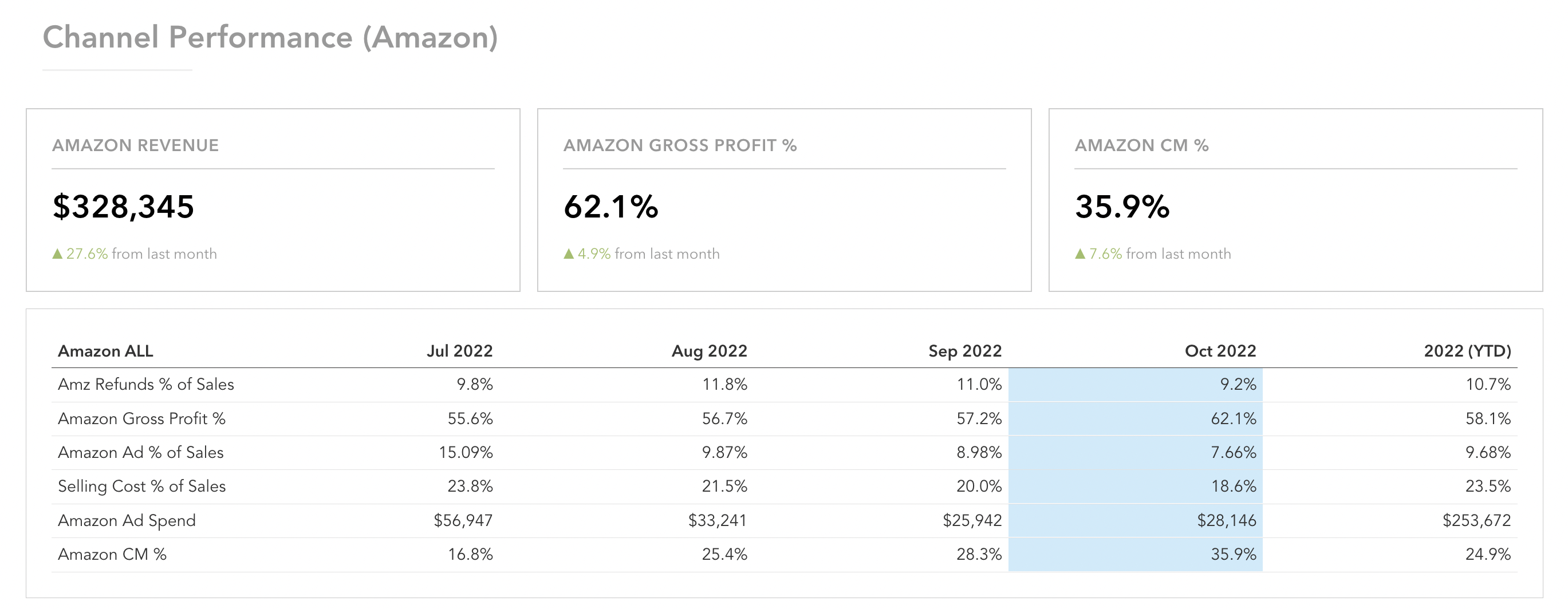

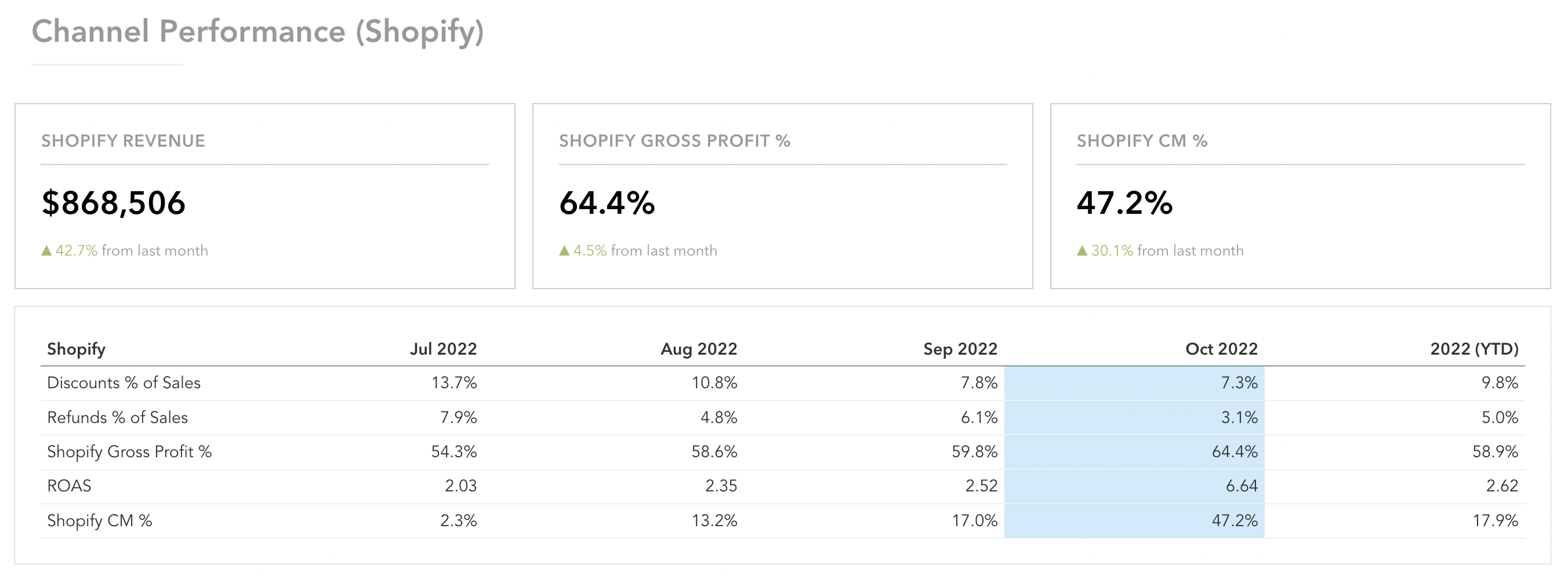

Channel Performance

Again, because we’ve taken more care in setting up the financials above, we can easily carve out KPIs like this for Amazon specifically.

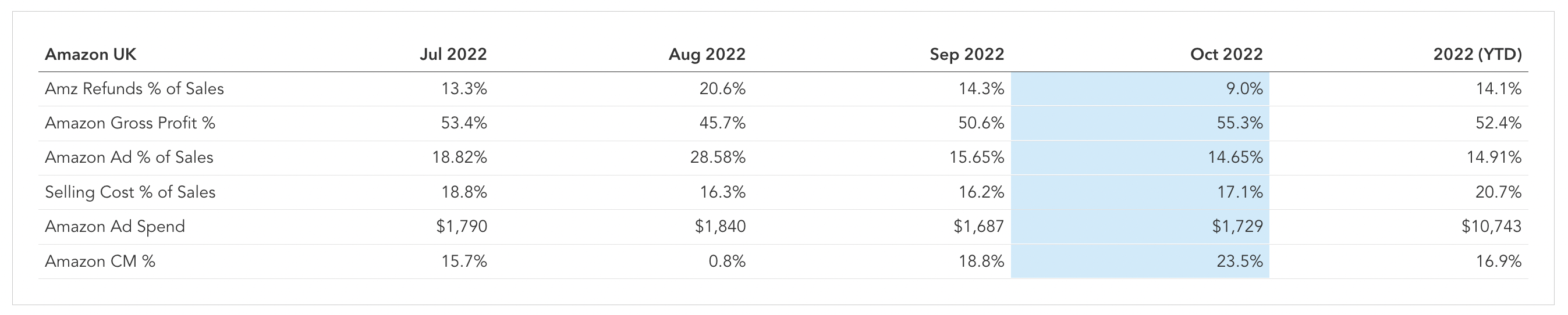

…and if you’re selling internationally

…and how this looks for Shopify

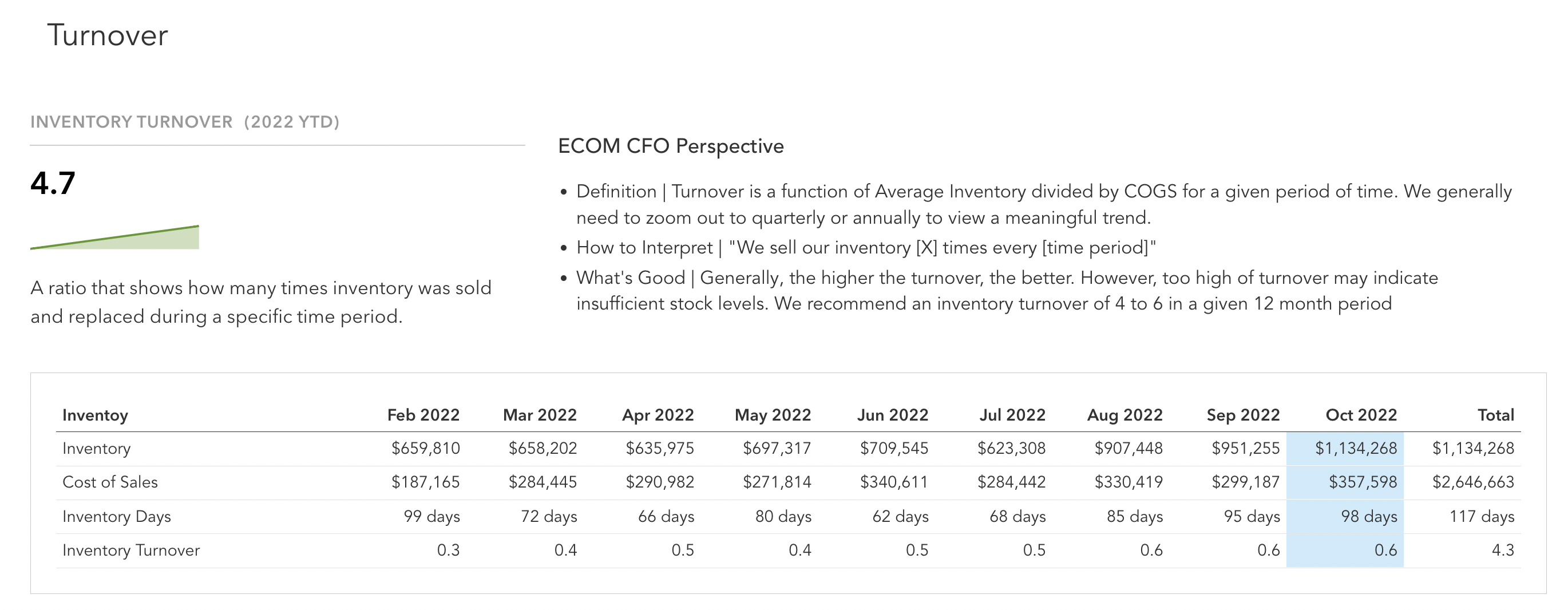

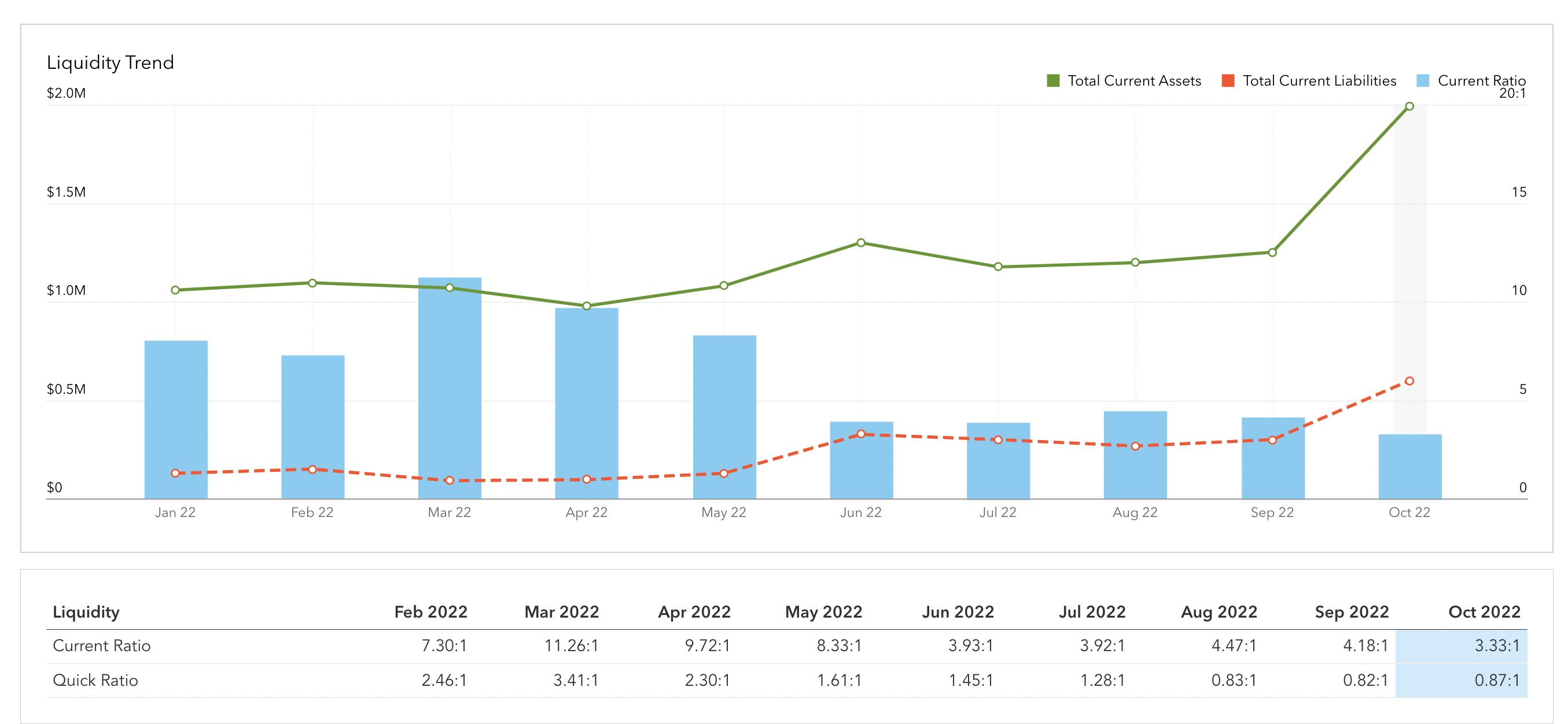

Balance Sheet KPIs

We setup an initial framework based on our experience and then discuss and customize for your business.

Example KPIs

- Return on Equity / Assets

- Inventory Turnover

- Debt to Total Assets

- Accounts Payable Days

- Cash Conversion Cycle

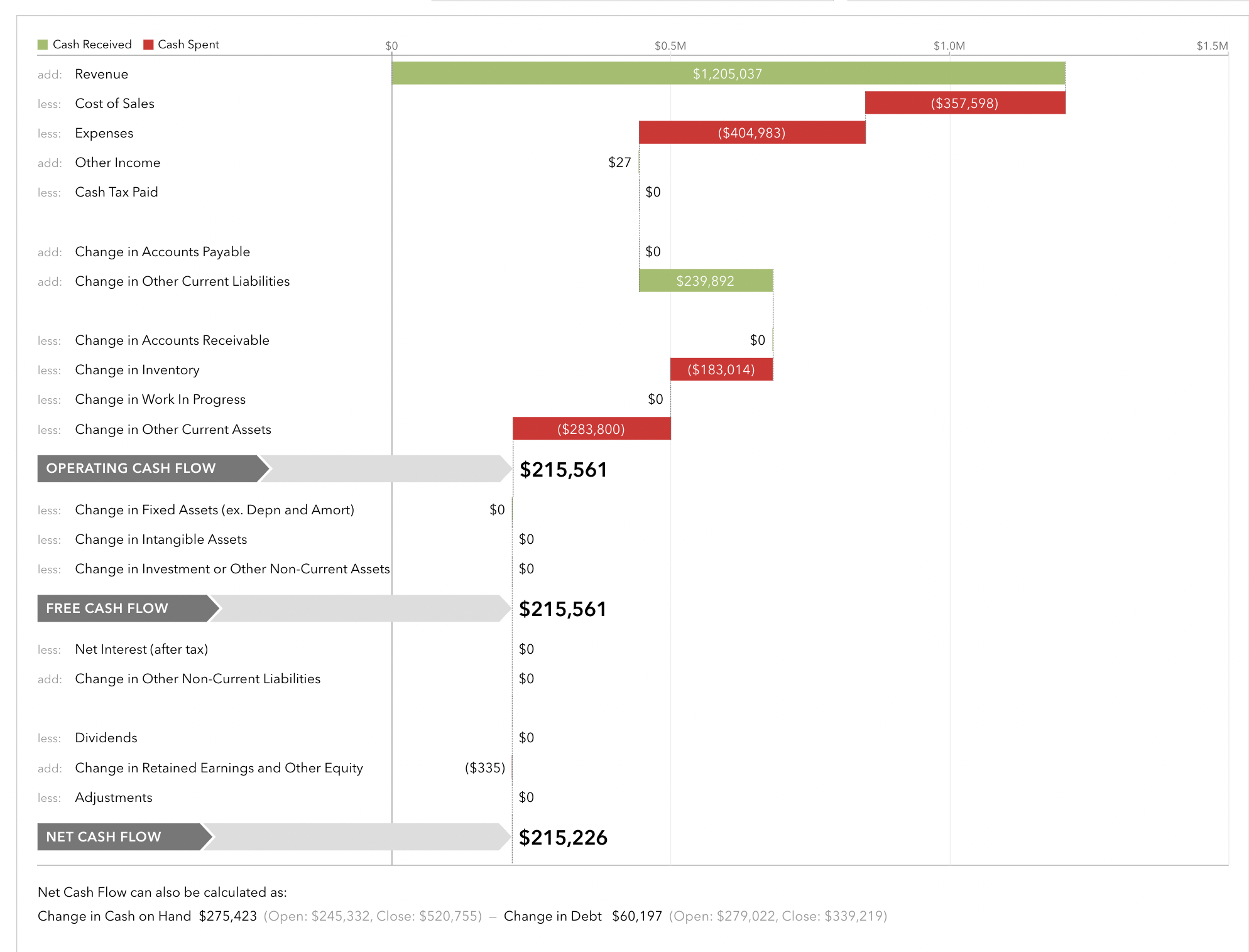

Cash Flow

We track operating, free, and net cash flow. And we can explain exactly how cash is changing month-to-month throughout your business

Summary

I hope you now have a better understanding of what we do to create your financials and deliver insights so you can make better decisions!

We’d love to hear from you if you’re ready to take the next step and schedule a call.