What You Will Learn:

- The benefits of outsourcing your business’s bill payment functions

- Tools that your business can use to improve the way it currently pays its bills

- The ins and outs of developing a personalized bill payment system

- How outsourcing can significantly improve your overall operations

There are a lot of exciting components of running your own ecommerce business. But there are also plenty of unexciting components including paying bills to vendors, contractors, and other relevant parties.

Paying bills is rarely (if ever) fun.

But it’s a necessary part of any business that wants to remain credible, continue operating, and gain effective control of its cash flows. Businesses ignoring the importance of efficient, functional bill pay will inevitably find themselves falling behind and even facing legal consequences.

However, while the importance of bill payment cannot be ignored, that doesn’t mean that your current bill-paying system can’t be improved.

In fact, by outsourcing bill payments to a reliable partner, your business can considerably improve its performance and position itself to thrive.

In this guide, we will answer some of the most common questions ecommerce business owners have about bill payment outsourcing, including what it is, its benefits, how it works, and more.

What is Bill Payment Outsourcing?

Generally, the term “bill payment outsourcing” can be used to describe any sort of system that uses external resources to facilitate receiving, managing, and paying outstanding bills.

These bills can come from a variety of different sources, including your suppliers, ongoing service providers (such as legal support, marketing support, etc.), contractors, third-party logistics, and more.

While the term “bill” can be casually used to describe any sort of payment obligation, in this context, the phrase will be used almost exclusively to describe payment obligations that come with a corresponding invoice.

As we will further explain in the “How it Works” section below, bill payment outsourcing functions depend on several important factors. These include:

- How your business is currently structured

- Types of bills you typically need to pay

- Size of your business

- Other factors

But while larger companies typically have a more complicated billing system than their smaller counterparts, almost every business can benefit from making the decision to outsource this important function.

What Type of Payments Does Bill Payment Outsourcing NOT Include?

Before further exploring the benefits of bill payment services for businesses, it is important to distinguish the “bills” that aren’t typically outsourced.

While your business will still need to make a bookkeeping entry for its credit card payments, for example, these payments don’t come with an invoice.

Therefore, in this context, credit cards, subscription services, ad spending, and other “non-invoiced” categories will typically not be outsourced.

Valuable Resources for Bill Payment Outsourcing

Because your business probably has a wide range of bills it will regularly need to pay, it’s important to have access to a wide variety of bill-paying tools.

To start filling your tool belt, you should begin by separating each bill into a separate category.

For example, start by distinguishing your payroll bills from your non-payroll (but still invoiced) bills. And, if needed, break down your payment obligations even further, such as separating W-2 payroll obligations from non-W-2 payroll obligations.

If you are making distributions to W-2 payroll workers, there are plenty of great options available, including Gusto, ADP, QuickBooks Payroll, and more.

Being able to use each of these can help make your business more dynamic. For non-W-2 payroll distributions, such as those that are for overseas contractors, consider using Wise, Bill.com, PayPal, or Hubstaff. Note the fees for international payments vary widely between platforms AND whether your staff is ultimately receiving local currency or USD. Do some homework before making a final decision!

If you don’t want to continually manage different platforms on your own, then outsourced bill pay might be your best solution.

Bill Payment Services: How Does it Work?

Developing a custom bill payment solution for your ecommerce business typically involves several moving pieces.

However, the process can usually be divided into three distinct components: initial setup, monthly bill processing, and annual bill processing.

Setup

During the “setup” component of the process, you need a general awareness of your business’s current financial position:

- Which payments does your business make? oHow often do you need to make them?

- Where is cash flowing in and flowing out?

- What type of payments do you typically make? ACH? Wires?

From there, your outsourced partner will create a bill pay process checklist that includes everything you need in order to be fully onboarded.

Depending on your business, this might include the integration of certain platforms (such as Bill.com, Wise, etc.), the inclusion of payment-specific email addresses, vendor lists, invoice templates, and more.

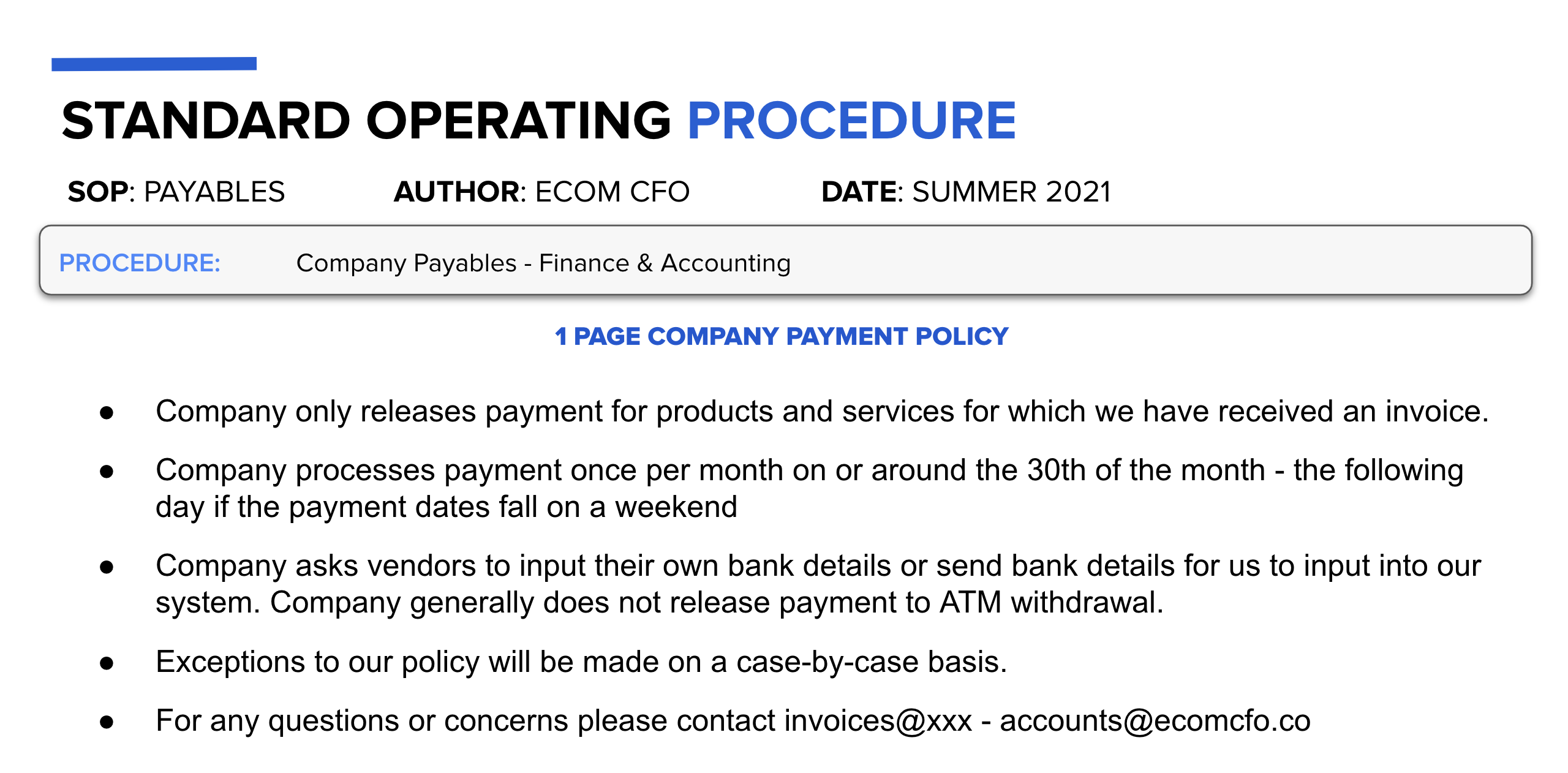

A common mistake we also see is not having a defined payment policy. Do you pay vendors every week? Every 2 weeks? Whenever you get around to it?

It’s easier to manage 5-10 invoices per month. But as you scale, your bill process needs to scale too – in both efficiency AND professionalism. In the setup phase, communicate your policy to vendors. It can be as simple as the example image below.

After that, you’ll be able to fully integrate and launch a payment platform that effectively meets your needs.

Monthly Activities

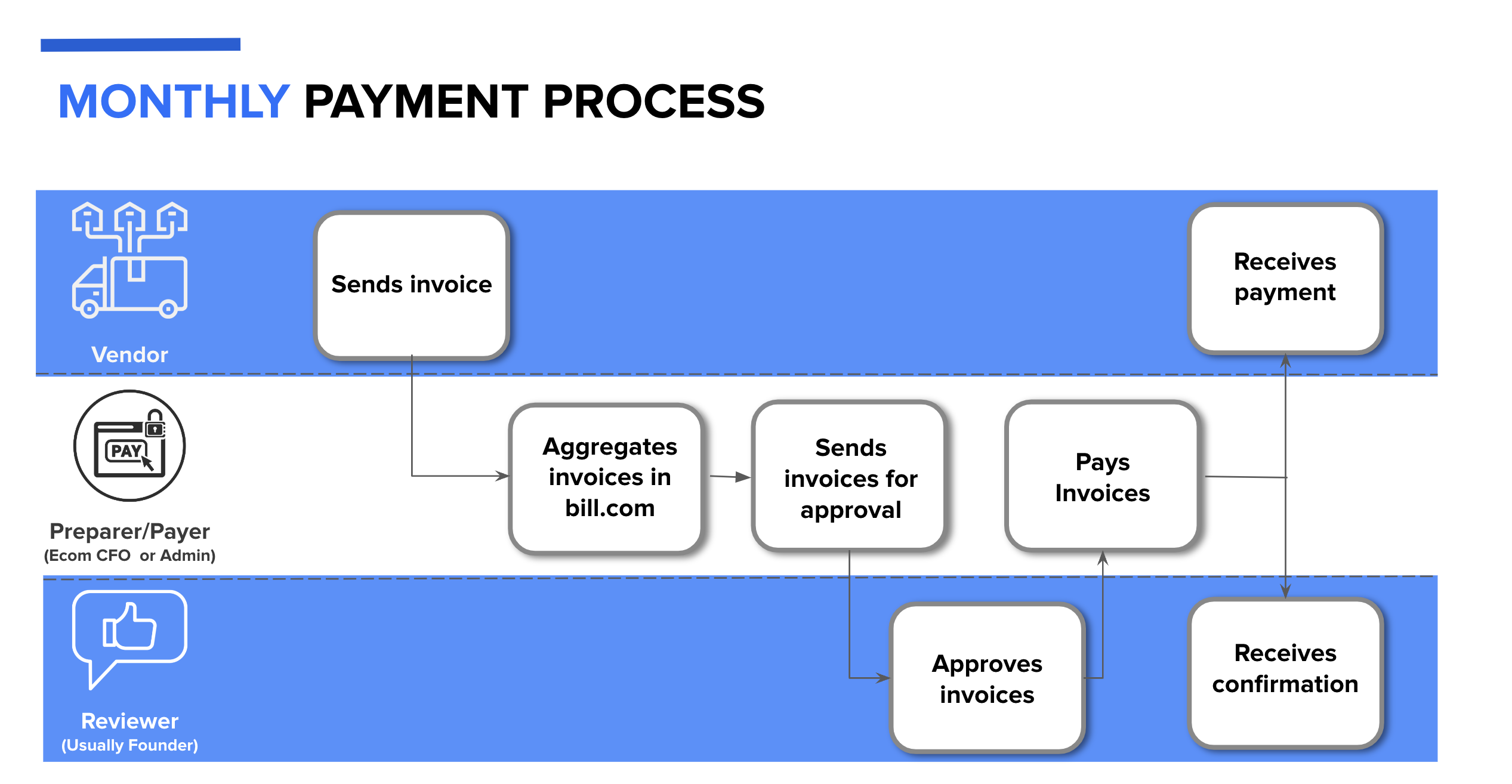

After setup, it’s time to actually execute the system you’ve created.

Entering bills. Approving bills. Paying bills. Reminding vendors of your (new) policy. Resisting the urge to pay invoices the day they arrive.

You’ve grown up now. Follow the process you created.

Annual Activities

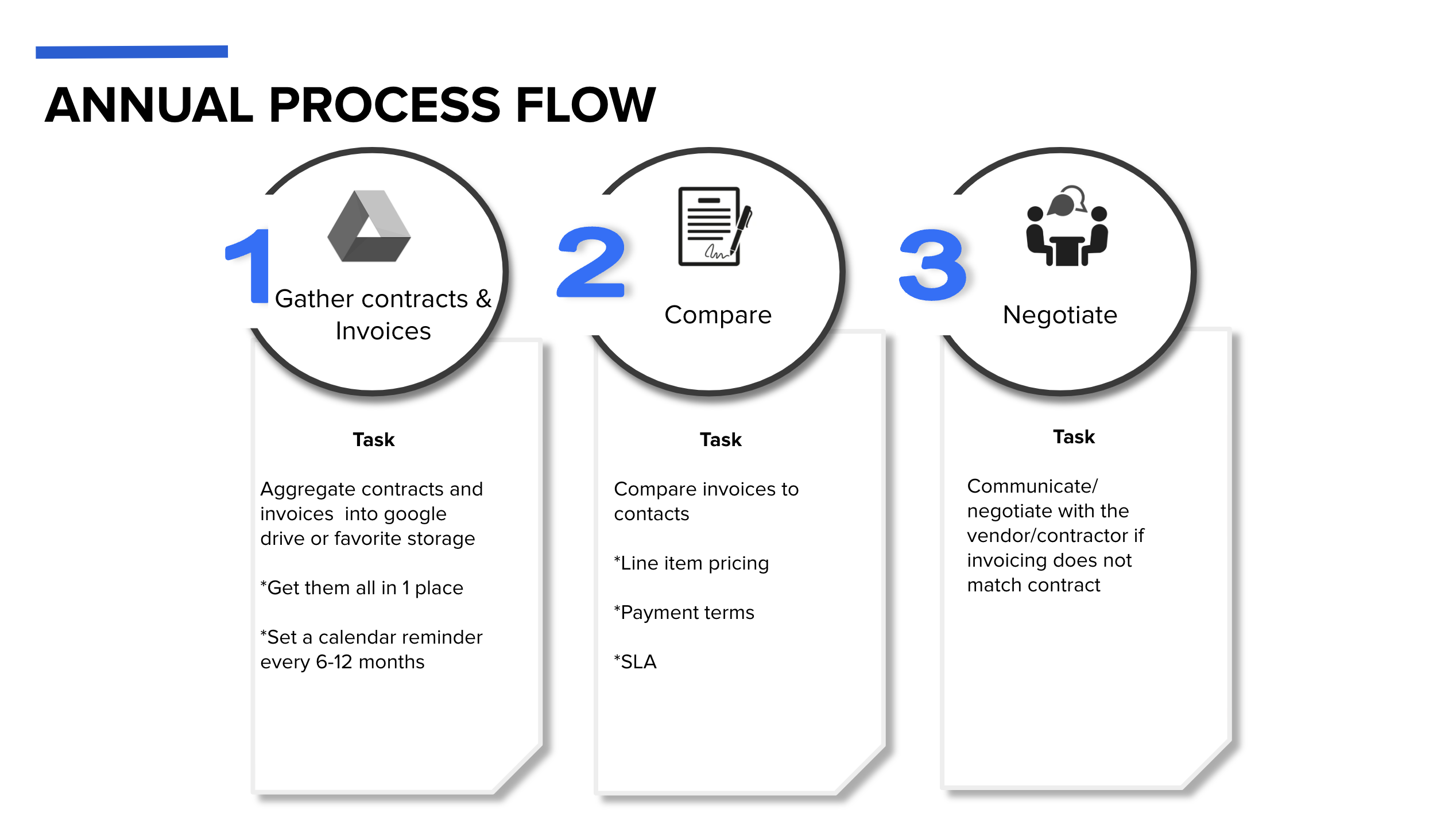

After the first year or so, it will be time to revisit your structure and make the appropriate adjustments.

Typically, this includes gathering current contracts (and outstanding invoices), comparing your “to-do” list to your “done” list, and negotiating future contracts, as needed.

Benefits of Bill Payment Outsourcing

Now that you’ve had some time to learn more about how bill payment outsourcing actually works, let’s take a look at why so many companies—especially within the competitive ecommerce sector—make the decision to outsource this essential process.

Focus on Core Business

If you’ve been through the process of manually processing invoices, adjusting accounts, and paying corresponding bills, you know how tedious that process can be.

And as the owner, you might find yourself wondering, “why am I the one who always has to do this?”

After all, your time could be better spent focusing on the revenue-generating portions of the business.

Bill processing is a task that can easily be outsourced – meaning whoever was previously in charge of this particular responsibility can use their limited time more productively. In most cases, outsourcing bill processing is one of the most straightforward ways a business can improve its bottom line.

Competitive Advantages

Finding ways to improve bill processing—such as outsourcing to a trusted partner—can help your ecommerce business establish a competitive edge.

Even if your ecommerce business operates entirely online, you’ll still need to develop positive relationships with vendors, contractors, support, and more.

There is no better way to improve this relationship than making sure that everyone who has sent an invoice is paid in full and paid on time.

Of course, this is in addition to the fact that most invoices represent a legal obligation to pay someone for services rendered (i.e. paying them isn’t a choice).

Introducing reliable, predictable, and accurate bill-paying systems will ultimately be beneficial for all parties involved. And in the fast-paced ecommerce ecosystem, that’s an easy way to pull ahead of competitors.

Reduce Operational Costs

One of the reasons business owners are hesitant to outsource certain manageable tasks is that they assume that doing something in-house will always be cheaper than hiring someone on the outside.

While this might be true for certain, highly-specialized tasks, it is not true for tasks that can be efficiently systemized, such as bill payment.

In fact, keeping payment processing in-house will often end up costing the company more.

This is the result of general inefficiencies, opportunity costs, late fees, added interest, and other factors that can each cause the bill payment process to cost more than is truly necessary.

Operational Excellence

In the end, the benefits of outsourcing bill payment all point to the same primary objective: helping your ecommerce business operate as efficiently and effectively as possible.

Paying your bills is an inevitable part of running a business and that means, one way or another, you will need to make a firm decision regarding how and when the bills are paid.

By comparing multiple outsourced bill payment options and identifying your current needs, you can immediately improve the way your business functions.

How We Can Help

We’d love to help you learn more about the ins and outs of outsourced bill paying, including how to set up a system that works for you.