Whether you’re doing this solo, with your executive team, or with a third-party (like an advisor) set aside dedicated time each month as your financial deep-dive day (preferably the same time on a schedule)

Half a day is plenty unless you’re doing longer term, annual planning

If you don’t have half a day, try 2 hours.

If you can’t find 2 hours, don’t worry. Your numbers will find you.

1. P&L Review: Look at the recent month’s performance and triangulate against three things:

- The previous month’s performance (can include last few months)

- Same month last year

- The budget (i.e., how you thought you’d perform)

These three points build the narrative of what happened, why it happened.

My old college baseball coach always said “he who has a why can conquer any how”. He meant something a little different.

But as an homage to him, I’ll offer “he who has a why understands how to conquer any how”.

Understanding the larger narrative helps you then decide on an action plan:

- Deep dive on SKU profitability?

- Amazon ad review?

- Yell at my meta agency?

- Review pick / pack / ship costs?

- Finally cut those fixed costs?

The right tools make a difference.

For example, the Fathom report we build for clients shows an overview of their P&L, and lets them instantly compare it to the previous few months, the same month last year, rolling 12-month average, and year-to-date totals.

We also pull their budget into that report, so they can review actuals against what they were expecting.

This can cut review time from a couple hours, down to minutes.

Important Note: I’ve written about this elsewhere, but I like to have reports for both percent and dollars (example below).

Sometimes a percent figure looks shocking, but the actual dollar-figure is negligible.

Seeing both allows us to quickly zoom back and forth between the macro and micro, identify real problems, and avoid making mountains of mole-hills.

Here’s a live example, showing how fast this can be.

- They’re surprised by how much fixed marketing has ballooned

- Forgot to shut off subscriptions (e.g., LinkedIn Recruiter)

- Didn’t realize how much certain contractors cost

This review allows you to make sure none of these go unchecked too long.

Another benefit is that you can catch and re-categorize expenses that might be in the wrong bucket (ex. team/models traveling for photo shoots – should be “content creation,” but often miscategorized as “travel”).

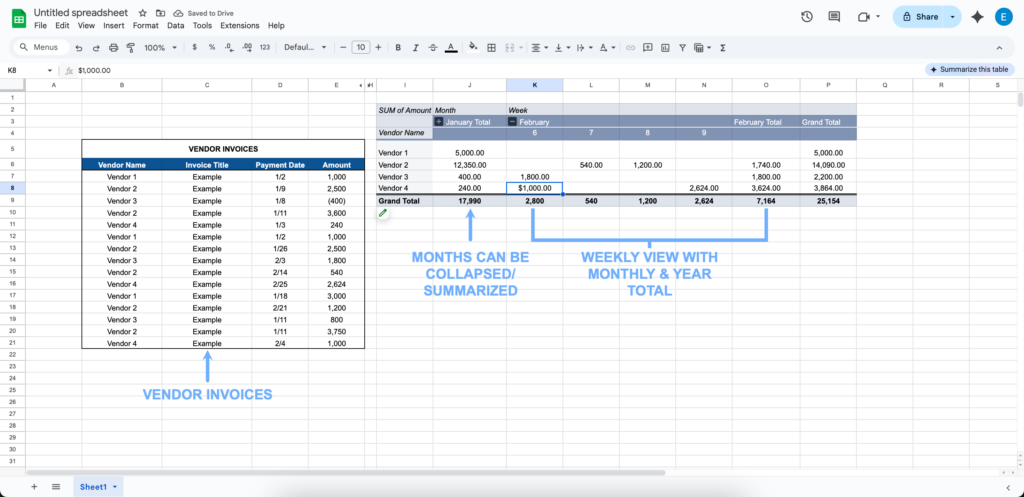

Our favorite way to review this is with a pivot table we designed for clients (below). It draws on Quickbooks to pull all their fixed expenses into one spot, then lays them out in a way that’s easy to review at both the weekly and monthly level.

You can filter by vendor type, and instantly see your entire history with a specific vendor.

Annual spend. Recent bills. If credits/refunds have been applied, you see those too. Easy to zoom from the macro to the micro without hunting around in your inbox or pouring over invoices.

We haven’t talked about the balance sheet.

That’s an article all its own.

For now, these two exercises will get you 80% of the value of the monthly review. If you do them, you’re better than most brands.

And if you want help with them, grab time with me here.