At some point, companies grapple with the question of cash v accrual accounting to record their financial transactions.

The concern is valid as the two accounting methods have their pros and cons, depending on the business model and the complexity of the transactions involved.

The difference between the two bookkeeping practices depends on when the business records financial transactions:

Cash accounting records revenue and expenses when payments are settled.

Accrual accounting records transactions when they occur, regardless of whether cash has changed hands.

Cash-basis accounting is simpler, and understandably, smaller businesses prefer it.

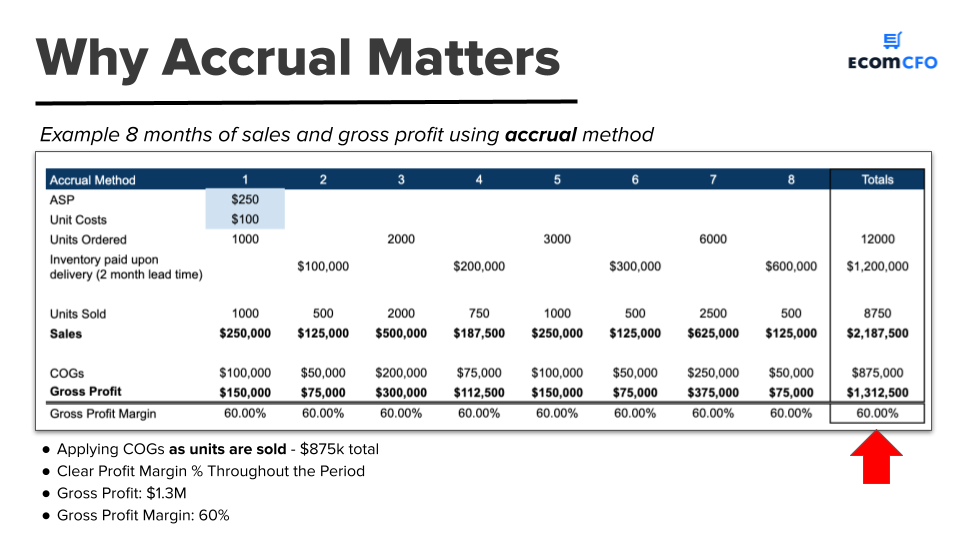

However, serious businesses eventually transition to accrual accounting as it provides a more comprehensive picture of a company’s finances.

Read on for more on cash vs accrual accounting, and which is the best for your business.

The Problem With Cash v Accrual Accounting

Businesses face 2 key challenges as they embrace cash or accrual accounting methods:

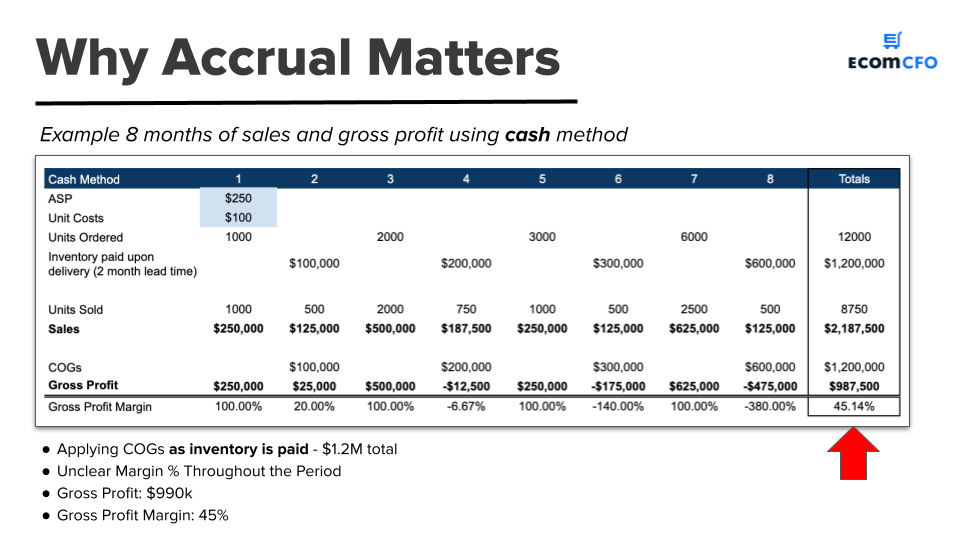

- Cash accounting provides limited financial information that is not reflective of the real-time business position. This makes it difficult to make appropriate and timely management decisions.

- Accrual accounting is complicated, costly, and time-consuming; It takes more organization since you have to decide on which accounts to accrue for. It is also heavy on paperwork as you need to track invoices and inventory. It will cost you to pay a higher level bookkeeper, controller, CPA or consultancy firm to help with the books.

Although the accrual basis is more costly and complicated, it’s a worthy trade-off as you obtain valuable insights into the financial health of the business.

Defining Cash v Accrual Accounting

Cash accounting

Cash-basis accounting in a business captures financial transactions at the point when cash is flowing into the business (revenue) or cash is flowing out (expenses).

Therefore, you create records when payments are made. If you received merchandise worth $3,000 from a supplier in January but paid for it in March, then you record the transaction in March.

In another example, if you sold $5,000 of goods on Amazon in February but the payment hit your accounts in March, then you record the revenue on the month you were paid (March), not when you sold the goods (February).

Accrual accounting

Accrual-basis accounting records revenues when earned and expenses when incurred. Therefore, the business tracks payments that you owe creditors and suppliers, and what you expect from your customers.

Accrual accounting provides an all-around up-to-the-moment picture of the business, and not just the cash at hand.

For example, if you sold items on Amazon worth $5,000 in February but you received the payment in March, you record the revenue in February although you were paid in March.

The same is true for amounts owed to suppliers where you note when the expense was incurred and not when you settled it.

The Basics of Cash v Accrual Accounting

Since cash-basis accounting is based on simple cash inflows and outflows, it’s more applicable for smaller businesses with less complexity.

Cash-basis accounting is straightforward and requires less time, and you can easily trace business income and expenses.

When to consider a transition to accrual-basis accounting

As the business grows, the debate of cash vs accrual quickly tips in favor of accrual-basis accounting for several reasons:

- Businesses that allow for credit card settlements; tracking numerous credit payments and receipts require an accrual accounting system.

- To keep a comprehensive record of the company’s assets (what others owe it, e.g. expected payments from Shopify or Amazon) and its liabilities (outstanding bills).

- Banks and other financial institutions may require accrual basis

- Required by law when annual business revenues exceed $25 million for over three years.

Hybrid accounting system

It doesn’t always have to be cash vs accrual accounting. Given that accrual accounting is costly and demanding, you don’t have to accrue all your accounts. You can opt for a hybrid system where you only accrue for some accounts.

Accrue some key accounts like the cost of goods, ad spend, and freight. Maintain cash accounting for accounts like payroll, insurance, and subscriptions which are settled in cash.

Common Mistakes with Cash v Accrual Accounting

- Failure to evolve to an accrual basis; many businesses overstay the cash accounting method when their business transactions and complexity have overgrown it.

- Misallocation of items in accrual accounting; the most common mistake in Amazon seller accounting involves misplacing variable costs under the cost of goods section in the chart of accounts.

- Not maintaining accrual records consistently. Preparing financials once a year doesn’t provide timely, actionable data.

Cash v Accrual Accounting and Ecommerce

The accounting method you employ in your e-commerce business will depend on several considerations.

The complexity of your business- most people start with a cash basis as it’s straightforward then migrate to accrual accounting as the business grows.

The use of other tools to help track accruals while maintaining your books on a cash basis. You derive decision-making support from the software while maintaining a simple cash accounting system for purposes of taxation. However, as you increase sales and the number of SKUs, accrual becomes more central to your accounting.

Cost of goods (COGS) is the most important account to accrue for in e-commerce.

- To accrue for COGS, you need to define the COGS for each SKU and then apply it to each order you sell on Amazon, Shopify, or your online channel.

- You can accrue the COGS manually on a spreadsheet or using software like A2X.

When to Implement

Implementing an accrual accounting mode becomes imperative in certain scenarios:

- If you’re a manufacturer, you should implement accrual accounting from Day 1.

- When sales exceed $1M or 25 SKUs that are not homogeneous – meaning – if you sell 25 phones that are the same, but of different colors, that’s less important. However, if you sell 25 different electronic gadgets, that’s more important.

- Ad spend – accrual accounting is less important if you’re advertising on platforms that take money out of your account daily, or every other day. However, for ads with billing terms of 30+ days (such as TikTok), consider accruing such a spend, if it makes up about 10%+ of your sales.