The best Amazon sellers aren’t just researching and listing products.

They are thinking through their entire business, including accounting.

As you scale your business, you’ll realize the need for a robust Amazon Seller Accounting solution to successfully navigate the Amazon ecosystem as transactions increase in volume and variety.

Initially, paper-based accounting and simple spreadsheets may get you going but prove ineffective as transactions and business complexity increase.

That’s when you’ll want to transition to the right combination of bookkeeping services and software for Amazon sellers.

Additionally, if you deal in multiple SKUs across several geographical locations, then sophisticated Amazon FBA accounting solutions, like A2X and QuickBooks, become inevitable.

The Problem with Amazon Seller Accounting

Typically, most sellers on Amazon aren’t accountants but entrepreneurs keen to scale their businesses.

As the business grows, so does the need for Amazon accounting services.

At this point, the excitement of selling on Amazon can be short-lived if you’re ill-prepared to tackle ever-increasing accounting complications like profitability and cash flow.

For most sellers, preparing books involves submitting receipts and credit card statements to a tax accountant or CPA at the end of the year.

An annual chat with your accountant is fine when you’re just starting.

However, as you scale, unorganized and inconsistent data will cost you thousands and then tens of thousands of dollars – as you’re either making a wrong decision or the right decision too late.

On the other hand, a business that prioritizes accounting regularly inputs relevant data from key sources and updates fundamental accounting records – allowing them to make sound management decisions.

The best entrepreneurs have a solid month-on-month picture of their business and are at a vantage point to make better business decisions.

Those who fail to invest in accounting miss out on critical developments in their businesses as they happen.

With a month-on-month financial picture of the business, you can make better decisions like

- Spotting opportunities for growth and profitability

- Identifying where you are losing money

- Notice (and respond) to market trends

Common Mistakes With Amazon Seller Accounting

There are common mistakes entrepreneurs make while preparing their Amazon seller accounts.

1. Using cash basis of accounting instead of accrual accounting.

Technically, cash accounting isn’t wrong – it’s how 90% of sellers start. However, as your business grows, it becomes necessary to transition to accrual accounting which helps you record transactions when they occur.

Whereas accrual accounting registers revenues and costs when business transactions happen, whether the money has been received or not, cash accounting only registers sales and expenses when the cash corresponding to those transactions is paid.

Transitioning to month-to-month accrual accounting may be the most important investment you can make in your business’s back office.

Seriously, do it.

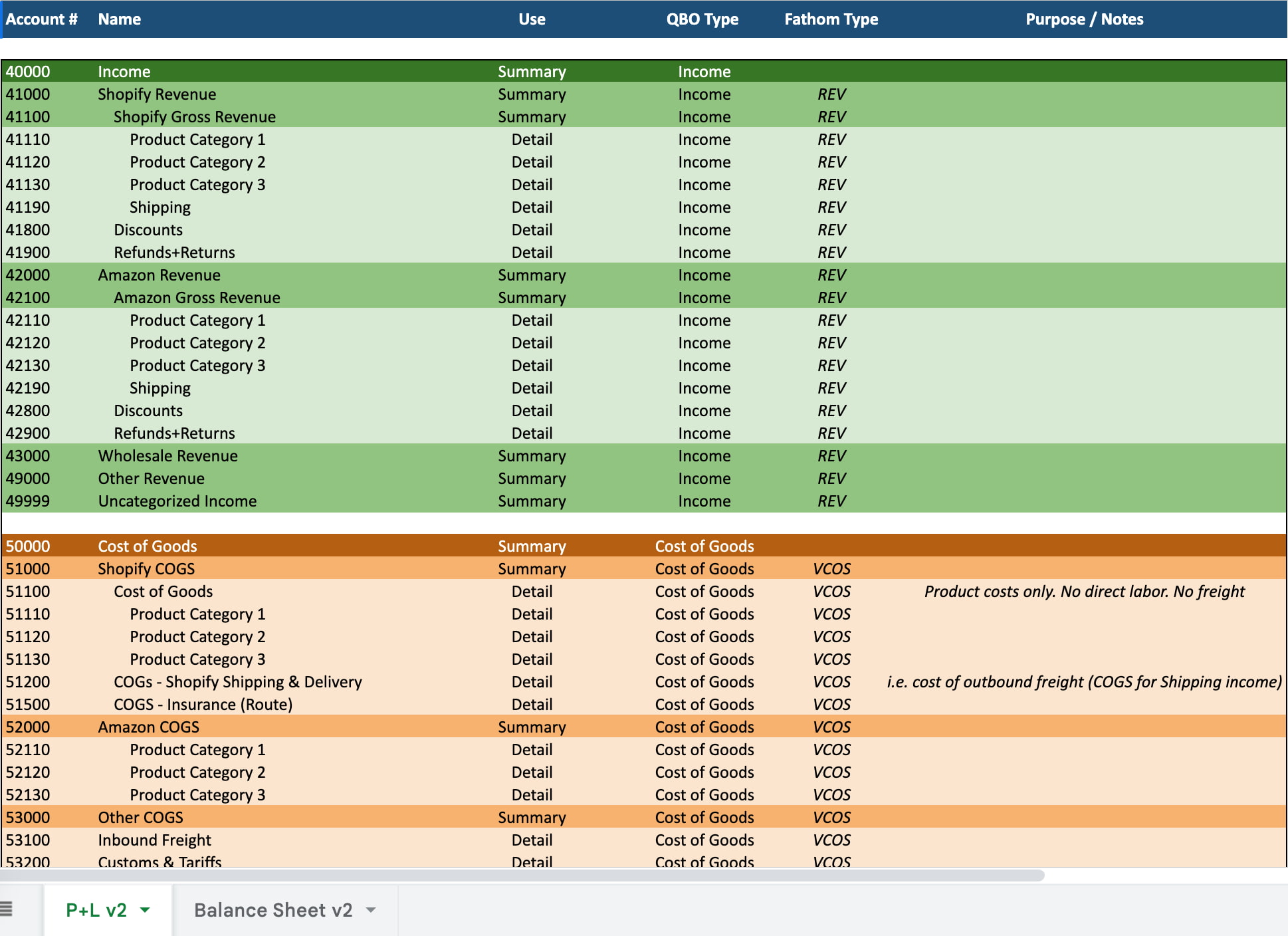

2. Failure to properly set up your chart of accounts.

When creating your chart of accounts for the profit and loss statement, you start with the income segment, then the cost of goods, then the variable expenses, and lastly the fixed expenses.

You must correctly set up these components of your profit and loss statement with matching entries to make sound business decisions from the information.

The challenge for most sellers here involves including Amazon’s variable expenses when calculating the cost of goods sold. Variable expenses should not be considered when computing the cost of goods but should come in later in the profit and loss statement.

Examples of Amazon’s selling expenses that you should exclude in calculating the cost of goods:

- Subscription fees.

- Shipping fees.

- Selling fees.

- FBA fees.

Although the above costs shouldn’t feature in the cost of goods sold, they must be in the variable expenses section of the profit and loss statement.

3. Ignoring the balance sheet.

Whereas the profit and loss statement assesses the overall profitability of a business over time, the balance sheet is most often forgotten.

Unfortunately, some Amazon sellers focus singly on the profit and loss statement and overlook the balance sheet – missing out on the overall pulse of their businesses.

A balance sheet helps you answer the following questions (that a profit and loss statement doesn’t address):

- What’s my cash position?

- Is my cash position changing over time?

- What is my debt level compared to my assets?

- What is my inventory value?

- How working capital do I have?

- Am I attractive to a bank?

- How much does Amazon owe me at the end of the month?

How to do Amazon Seller Accounting on Your Own

It is possible to do Amazon seller accounting on your own if you’ve got the time for it. If your sales are below 1M dollars monthly, and you’re using QuickBooks, you’ll probably spend 10-20 hours per month.

A2X is a superb add-on for any Amazon seller since it’s a seamless interface between Amazon and QuickBooks. It helps you populate appropriate journal entries from your Amazon seller account to generate valuable information for decision-making.

The accounting gets more complex when your revenues surpass the 1M dollar threshold- and you’re dealing with multiple geographical locations – you’ll require more time or consider outsourcing to a combination of software and an Amazon seller accountant – like us!

If your business is $5M+ and includes several Amazon channels, FBA (Fulfillment By Amazon) and FBM (Fulfillment By Merchant), the accounting will be even more complex and time-consuming. It will be time to seek an expert firm!