Recently, we wrote about financial reporting, and how different layers of abstraction allow you to zoom out and make better decisions, faster.

In this piece, we’re diving into a component of good financial reporting: budgeting and forecasting.

Founders often find this overwhelming, but it doesn’t have to be.

Our template makes it way easier, and today, we’re gonna unpack:

- Major obstacles and how to avoid them

- The budgeting/forecasting process

- When to do this, and how long it takes

Invest the time, and you’ll not only get clarity and peace of mind, but also, a tool to help make tough decisions throughout the year – about things like marketing budgets, inventory purchases, hiring, firing, SKU rationalization, etc.

Fail to plan, plan to fail.

1. Major Obstacles and How To Avoid Them

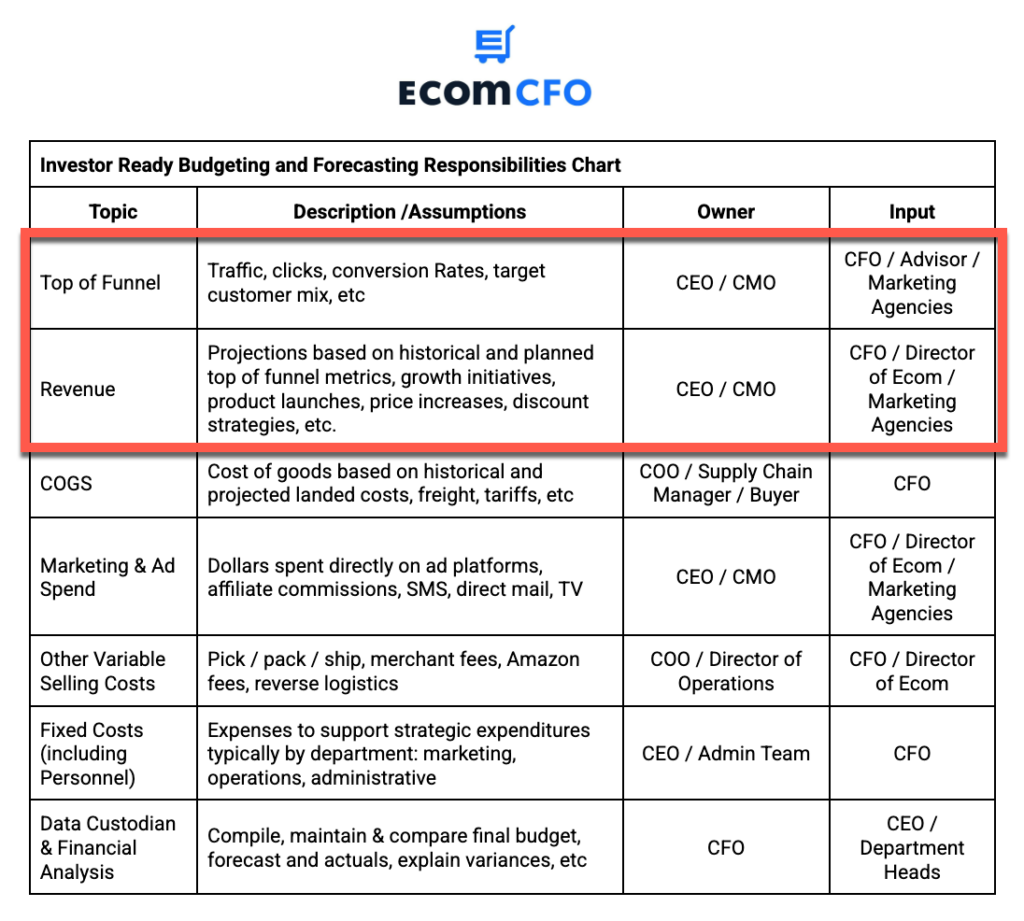

One of the main things I see founders get wrong is understanding and assigning ownership.

Without clear ownership, you end up with nothing.

A few weeks ago, I showed you our Monthly Responsibility Map (another resource clients love). We have one for annual budgeting too 👇

A few important notes:

- Your CFO (we) should never own revenue predictions: They (CFO) should have input, but this belongs to the CEO, since it is heavily dependent on the CEO’s risk tolerance. How much risk are you willing to take on the success of those new products, new channels, and growth initiatives?

- Spend most of your (CEO) time on the first two lines: You need to feel confident in these numbers for the rest of the budget to mean anything – top of funnel and top line revenue.

- Remember to zoom out before zooming in: Don’t get hung up talking about specific ad channels or fixed costs too early. Understand directionally the biggest levers that have more impact on the bottom line first.

The responsibility map essentially mirrors the P&L, and after the first two lines are firmed up, the rest are simple (though not always easy).

2. How To Do This: The Budgeting/Forecasting Process

At a high level, there are three parts:

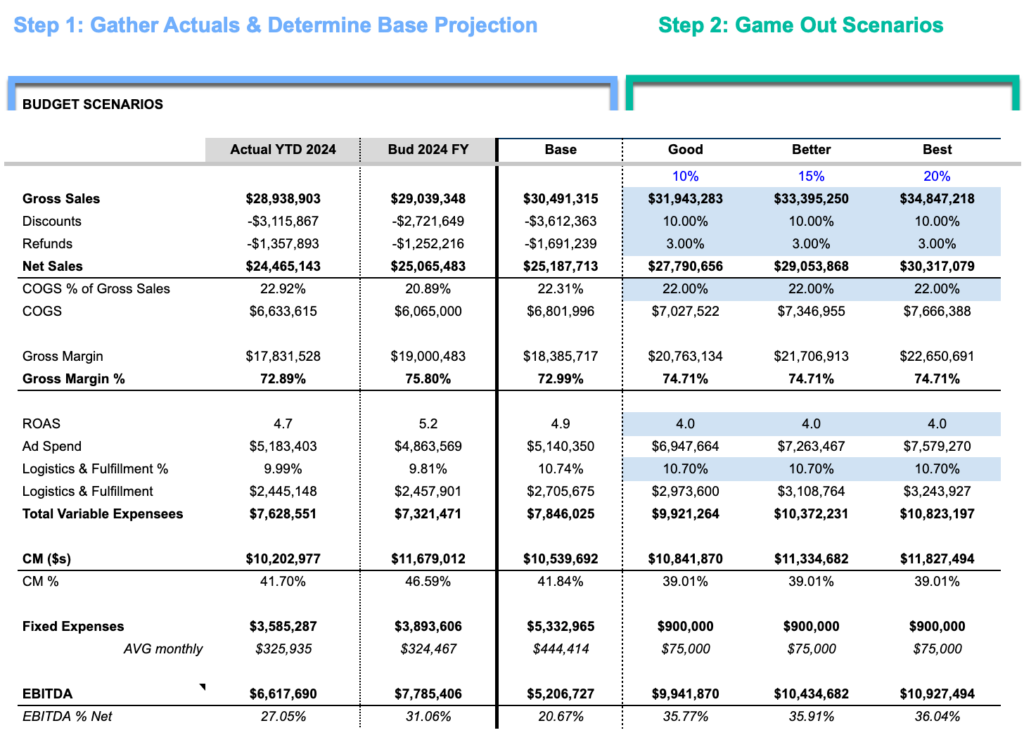

- Gather Actuals: Before sitting down with a client, we pull their numbers from the previous year, and if they had a budget, we add that too. Then we build a base forecast without their input – basic, essentially just showing what this year would look like if it were similar to last year.

- Game Out Scenarios: We sit down with the client and play with potential growth, gross profit targets, EBITDA targets, and levers they can pull to get there. This is typically the “Ah-ha” moment where clients understand where they need to deploy the most resources.

- Dive Into The Details: As we review the previous year’s data, and game out the year ahead, we are oscillating between 30,000 ft and line-by-line detail (sometimes within the same minute) to explore where the money went last year, and whether we want to change that allocation this year.

This repeats over a few iterations, until we work out a budget that feels right.

Steps one and three, we’ve talked about elsewhere.

But, let’s doubleclick on part 2 – gaming out different scenarios…

This is done in the “Scenarios” tab of the template. As you work through it, here are the 3 simple (not easy) questions to ask yourself.

1. How much will you grow next year?

Triangulate your growth projections on your own past performance, the performance of other private brands, and the performance of public DTC brands.

Your own past performance is the biggest consideration, and should get the most weight. For the other two, use our P&L Benchmark Report – it’s the document I wish I had working with clients in the past.

2. What is your target profit?

Start with the end in mind – the EBITDA % and/or EBITDA $s you want to achieve. For those with fixed assets and monthly interest payments, drop the “I” and the “D”.

Over the years, I’ve learned (positive) profit targets are inherently irrational for our bootstrapped clients. Some are optimizing for a future sale, while others are eyeing a vacation home.

Whatever the goal, optimize for EBITDA, then work backwards, tweaking the scenarios to see what has to be true for us to get that result.

3. What are the biggest levers at your disposal to succeed?

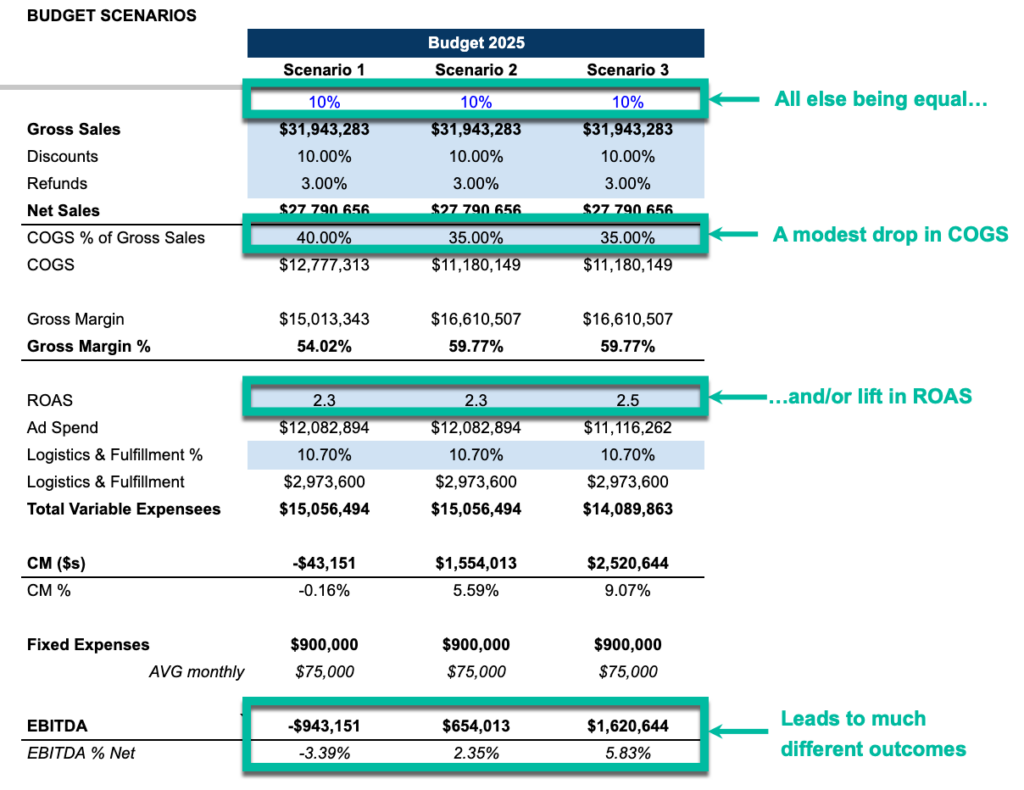

COGS and ROAS are the first places we typically look with founders, and the inevitable response is, “Wow, I didn’t know the impact was that big.”

Everyone always hopes to boost ROAS. But as you can see below, cutting COGS has a huge effect on the bottom line too.

Since most brands we work with are 100% owned by the founder, more profit equals more money in their pocket personally. So this is usually the nudge they need to…

- Raise Prices

- Negotiate with Suppliers

- Work on discounts, refunds, and returns

- Do other things that improve gross margin

The template also shows you which scenarios result in negative EBITDA – literally the difference between buying that new house this year, or potentially losing one.

3. Finally, Let’s Talk About When To Do This…

If you’re looking for some general rules about timing, here are mine:

- In a perfect world, start this during Q4

- If that’s absolutely not possible, January is okay

- The more people involved, the longer this takes (but typically, 30 to 60 days)

Also, because the budget drives inventory purchase decisions, lead times should inform when you start. If you’re in an industry with longer lead times (like apparel), you’ll want to adjust your start-date accordingly.

As with everything, there are levels to this game.

If this is your first time budgeting, don’t expect to go from zero to a hundred.

Instead, major on the majors, and commit to continually improving the process over time.

Here’s what I consider minimum/better/best for this practice:

It’s never too late to do something this important.

I’m writing this in March, but if you’re reading in July and you still don’t have a budget for the year, I’d encourage you to grab the template, and go through the process of filling it out.

Better late than never.

And if you want help with yours, grab time with me here.