In a previous email, we talked about the P&L review to spot problems in your company before they snowball.

Today is the balance sheet.

When I do this with clients, it’s usually faster than the P&L review. Barring a catastrophe, the main things we do is take 10-15 minutes to sanity check:

- Cash on hand

- Inventory

- Other Current Assets

Here’s exactly what to review at, and why…

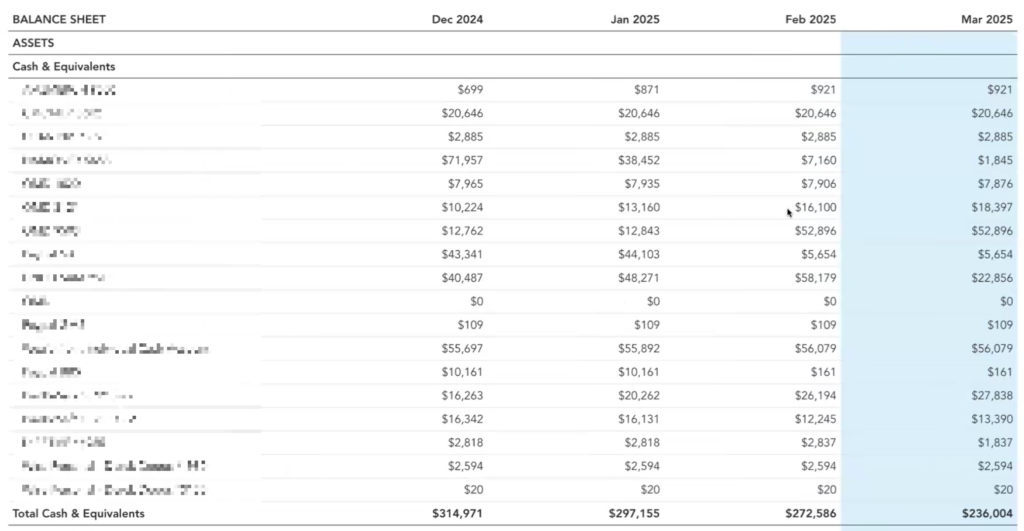

1. Cash On Hand

A typical owner has 5-15 places they keep cash and cash equivalents.

We’re talking bank accounts, Paypal, and even Shopify, which recently started offering almost 4% APY on funds held in balance.

First thing we do is make sure our list of accounts is up to date (sometimes clients make new ones without telling us).

Then, we compare against the previous month, looking for:

- Any major decrease: On its own, not a problem, but a signal to review the statement of cash flows and make sure the owner knows what happened

- Cash they want to move: Either to build up one account (for payroll, inventory, etc), or draw down another

That second bullet changes a lot based on the preferences and risk tolerance of the founder.

Example – since the SVB meltdown, some prefer to limit cash in any given account to the $250k FDIC guarantee. Others don’t.

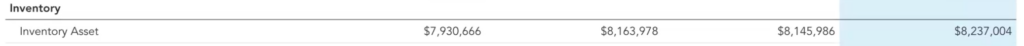

2. Inventory

We derive this figure from several sources too complex to go into here.

But the gist is that we’re gut-checking with the client to make sure the numbers in the books match their understanding of the situation on the ground.

If there’s a variance, we decide whether it’s big enough to warrant more review. My rule of thumb is…

- 1 – 2% → Near-zero concern

- 2 – 5% → More concerning

- >5% → This is a problem

- >10% → This is a big problem

If our records show $10M in inventory, and you think that’s off by 10%, that’s a million dollars in product unaccounted for.

If your EBITDA is $2M/yr, we’re talking 50% of EBITDA value in the wind.

Big problem.

To help avoid this, best practice is to send us inventory counts once a month. Doesn’t always happen, but that’s best.

The depth of the concern is also contingent about bank compliance – i.e. lines of credit. Some banks require monthly reporting from both the inventory and accounting systems. If they don’t match, banks get uneasy.

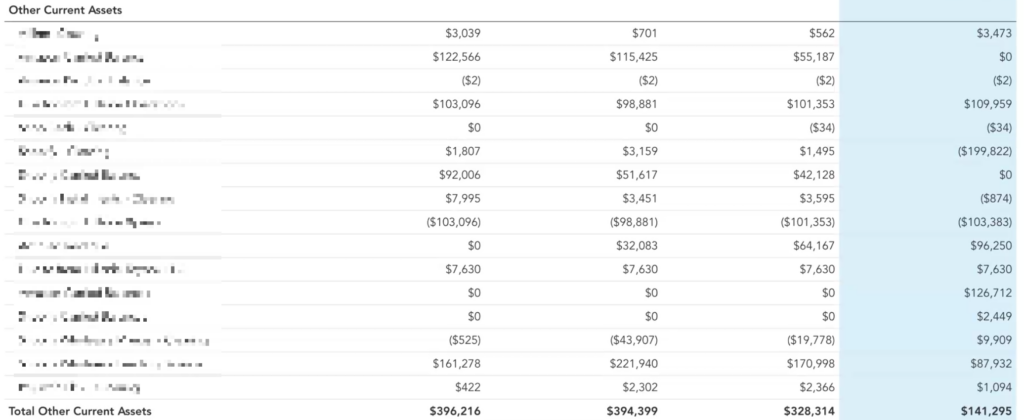

3. Other Current Assets

I don’t typically expect founders to have a deep understanding of this section (but brownie points if you do).

It’s (usually) made up of two things

- Pending Accounts: Money that platforms like Amazon and Shopify hold back, to cover chargebacks or returns against your account

- Clearing Accounts: A running difference between actual bank deposits and sales channel reporting – lots of fun issues can happen here

The difference between these two is largely irrelevant for a CEO.

What we’re doing is identifying any material difference in amounts or large swings month to month.

(Here again, “material” is relative. A $500k change could be serious for one founder, and negligible to another).

Those three are the big ones. Other lines we glance over are:

- Fixed Assets: Typically not changing month-to month unless you’re doing construction or buying/selling equipment

- Short Term Liabilities / Accounts Payable: Quick pulse check to make sure the credit cards and what you owe to people seem reasonable

- Other Non-Current Liabilities: If you’ve got an SBA loan, this is where we’ll track the balance as it’s paid off

- Owner Contributions / Shareholder Distributions / Equity: Another sanity check, but this plays out more in the cash flow analysis (a topic for a future article)

Like everything, there are levels to this review – good, better, best.

Good would be a 2-5 minute review of the balance sheet to make sure there are no fires to put out.

Better is going one step further – using data from the balance sheet to track KPIs like current and quick ratios over time, debt-to-assets, cash conversion cycle, inventory days, etc.

And “Best” is to do both of these regularly to keep things from piling up.

If you want help putting that kind of system in place, grab time with me here.