Cash reserves are usually very personal for DTC brands – every founder has a different (often, not fully rational) amount they prefer to keep on hand.

Going below that mental threshold creates extreme anxiety.

Having investor-ready financials reduces anxiety by revealing problems quickly, and making the solution clear.

BUT the P&L and Balance Sheet are accrual-based, with income and expenses recorded when they’re incurred, rather than when cash changes hands

To truly keep your ass solvent (always the goal of this newsletter), we need a view distinct from the P&L…

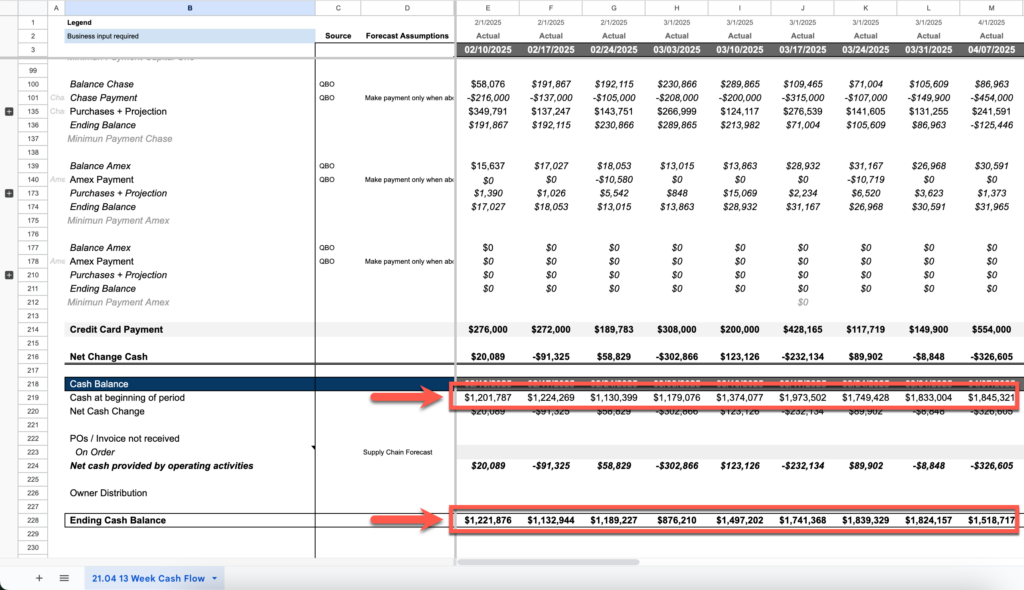

We’re not providing our 13-Week Cash Flow template for now (but screenshot below) – too much customization done on a client-by-client basis to provide real value for you.

But whether you’re using your own, ours, or another system, it pulls all your actual and expected cash in and cash out into one spot.

Shows you how much you have today, how much you are projected to have tomorrow, and what the difference might mean moving forward.

Depending on the client situation, we’re typically preparing this weekly and the review looks like this:

- Look at the starting and ending cash balances for the current week

- Understand what’s driving the change

- Look at the max cash deficit over the next 13 weeks – is there an issue we need to address?

- If so, decide on an action plan – could be its own newsletter – but common actions are postponing, cutting, and renegotiating

Note – An “action plan” can get really messy really quickly. Recently, an action plan with a client evolved into a new policy of charging clients for shipping (instead of offering free shipping). This change would (theoretically) improve cash flow but obviously have cascading effects across the business.

This is the line between finance, operations, and marketing. Ultimately, the owner / CEO has to make the hard decisions.

Back to cash flow review

This review isn’t just about seeing how much cash you have on hand. Even large cash swings week to week aren’t cause for alarm on their own.

It’s about knowing where the cash went, what it means for upcoming weeks, whether you have to worry, and what you can do to fix it.

If cash is tight, first area to review is usually credit card or supplier payments – Do you carry a balance on the card (and take the hit in interest)? Or disappoint a supplier?

It’s a tough call to make. But Meta and Google do not give one single fuck what your problem is. If you don’t pay, your ads don’t run.

So if the decision is either paying a supplier, or freeing up spend on the credit card, the card typically wins.

On the flip side, sometimes you have more cash than you expected (good problem to have).

Then, you have different decisions to make: Are you saving for a big inventory purchase? Will you hire? Maybe take a distribution?

In both cases, having a clear picture of your cash situation is key.

How does this change for 7, 8, and 9-figure brands?

As with most of our content, we’re using revenue as a proxy for complexity.

I’ve seen $100M companies run on a spreadsheet and <$2M companies require 10 hours of CFO time per week to run this process.

So, use the chart below as a guide, not gospel.

Across all stages, the goal is to shift time and energy away from data wrangling and toward strategic interpretation and action planning. The tools and cadence must evolve, but the forecast should always be understandable and actionable for leadership.

This isn’t magic. And certainly not unique to ecommerce. Any financial analyst, high level controller, and certainly a CFO would be able to construct this.

The secret sauce is not aggregating the data – it’s interpreting it.

While the decisions are similar no matter your size, the scale and impact of those decisions changes dramatically.

The Cash Discipline Spiral

Aside from exposing problems and opportunities, the other benefit of this review is that it quickly reveals the importance of being disciplined with cash, and keeping a strong balance sheet.

Good behavior creates an upward spiral of opportunity, with cash to invest in things like bulk purchases, marketing tests, HYSA, people – which in turn boost margins, spitting out more cash, and so on.

The opposite is also true.

When you’re cash-constrained, you’re bogged down thinking about…

- Whether or not you’ll make payroll

- Which suppliers you need to disappoint

- Which credit cards to pay off every day to keep your ads running

You’re not thinking about how to be competitive, which products you’ll launch, or how you’ll respond to other market dynamics that crop up.

You’re just trying to get through the day.

That’s how you get out-competed.

There are ways to get yourself out of that position and strengthen your balance sheet (ex. Grow less, order less, stock out. etc.).

But it all comes back to having the discipline to

- Take your financial reporting seriously and

- Act on it.