Sam here.

I’m done convincing people they need a plan.

If you’re still debating whether planning matters, today’s newsletter isn’t for you.

This is for operators who already have a plan—you’ve got projections, you’ve built models, and now you’re trying to figure out if your baseline is realistic or if you’re setting yourself up for failure.

What does the data say?

Ecom CFO Benchmark Data

We published our 2026 Revenue Planning Guide last week.

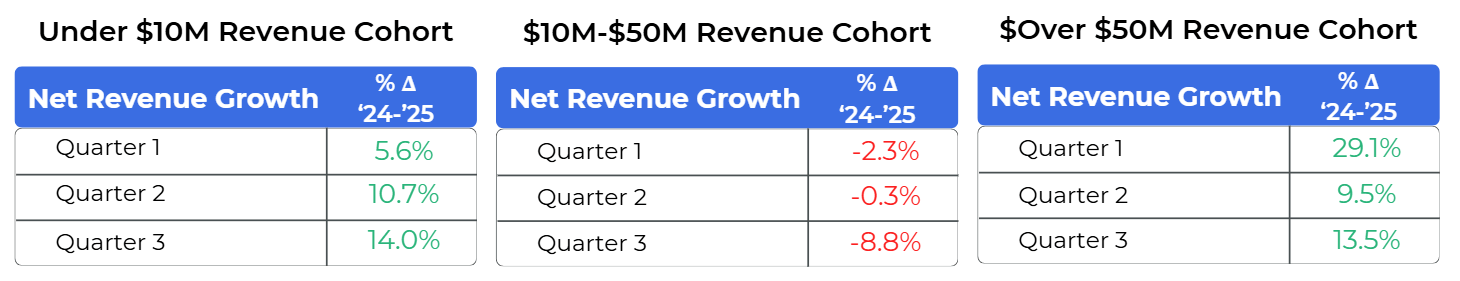

Go read it (at least the executive summary). I’m calling out page 10 today in particular. Past performance is not indicative of future results but I think it does provide great perspective going into 2026.

Here’s what we saw across our client base:

The pattern is clear that most brands are growing somewhere between 8% and 14%. There are a few outliers as with any data but only one cohort, in one quarter, broke 15%.

It’s the end of easy mode.

The 10% Baseline

10% revenue growth is the baseline I recommend for 2026 planning.

When I say “baseline,” I mean the expected growth rate from your core business if nothing major changes. No hero product launches. No new channels. No retail expansion. Just better execution on what you’re already doing.

10% assumes the game on the field stays roughly the same (which is what I expect):

- Ad costs keep climbing

- Interest rates don’t drop faster than expected

- Consumer sentiment stays flat or slightly improves

If you’ve got a real reason to bet higher—launching a product that’s already validated, entering a new geography, or adding a proven channel then, yes build that into your model.

But I wouldn’t expect the macro indicators to be pushing your revenue like it has in previous years.

The Cost of Getting It Wrong

I’m seeing more clients in cash flow crisis than I’ve ever seen.

Some brands have week-to-week viability, are losing their lines of credit, and some are self-funding payroll because the bank looked at their P&L and said “no more.”

What happened? They forecasted 25% or 30% growth. Ordered inventory to support it. Hired to scale it. And the revenue didn’t show up.

Now they’re in a death spiral.

This is not me trying to strike fear. This is just my lived experience from what I’m seeing and hearing from clients.

The risk of over-forecasting revenue is way worse than under-forecasting. If you’re conservative and you blow past your plan then you stock out for a few weeks, pause ads, and miss some algorithm magic.

But if you’re aggressive and you miss, then you’re sitting on six months of dead inventory, burning through a credit line you can’t pay back, with a team you can’t afford.

I’ll take the algo risk.

Where Rubber Meets Road

I hear founders say all the time that they can’t project revenue because it’s so ad dependent. I get it – you want to be able to take advantage if one of your ad creative sets goes off.

OK, fine, but where does the rubber meet the road?

You’ve got to put in inventory orders 60-90 days out. You’ve got to invest in headcount and other fixed costs that aren’t instant.

With marketing you can literally throttle ads by the hour.

But you can’t throttle people by the hour.

That’s why it’s important to have a forecast and budget. These are decisions that need to be made ahead of time.

What’s Your Number?

What are you planning for 2026?

If it’s more than 10%, what’s the step-change lever that justifies it? Is it a new product? A new channel? A geographic expansion? An acquisition?

Look at the game on the field. The consumer environment hasn’t changed much. Ad costs keep going up. Platform fees keep climbing. Tariffs are still a mess.

If your plan is just “execute better”, then you might be over-indexed.

Curious if you agree or disagree with my view on the 10% baseline? Reply and send me a quick note, I’d love to hear what you’re projecting for the year.

— Sam

💼 This Week in Ecom (What I’m Paying Attention To)

- EcomFuel – Financial Mastery: Podcast from Andrew Youderian with helpful reminders for founders on risk management and oversight to prevent chaos.

- Deal Alert from Fan Bi: High-growth, mission-driven DTC personal care brand exploring strategic options. $15M+ LTM revenue; $20M+ budgeted for 2026 and 80% subscription revenue with strong retention.

- Operators Year in Review: The Operators discuss their 2025 Year in Review report with an emphasis on Marketing data. This is a great resource to pair with our P&L Benchmark Reports.

- Zappy Sales Hiring Head of Finance: Awesome opportunity to work with one of our best clients!

📊 Benchmark Reports

- 2025 Q3 Benchmark Report: We analyzed financials across 30+ companies to show you exactly what happened – including revenue growth, margins, ad spend, and more.

- Cash Unlocks Report: We analyzed inventory turns, months of runway, and working capital (current ratio) across 5 DTC brands ranging from under $10M and above $50M. This report includes all the benchmarks and insights to identify and attack locked up cash in your business.

🧭 Footnotes

Other Resources Clients Find Helpful: Here are a few tools we’ve built for clients and find ourselves sharing over and over…